DALLAS — The other night I was up well past midnight engaging in a little spreadsheet review of IRS data. Do you know how lonely that made me feel? Then it got worse. I saw a report published by the Internal Revenue Service last year about all the tax activity from fiscal year 2022.

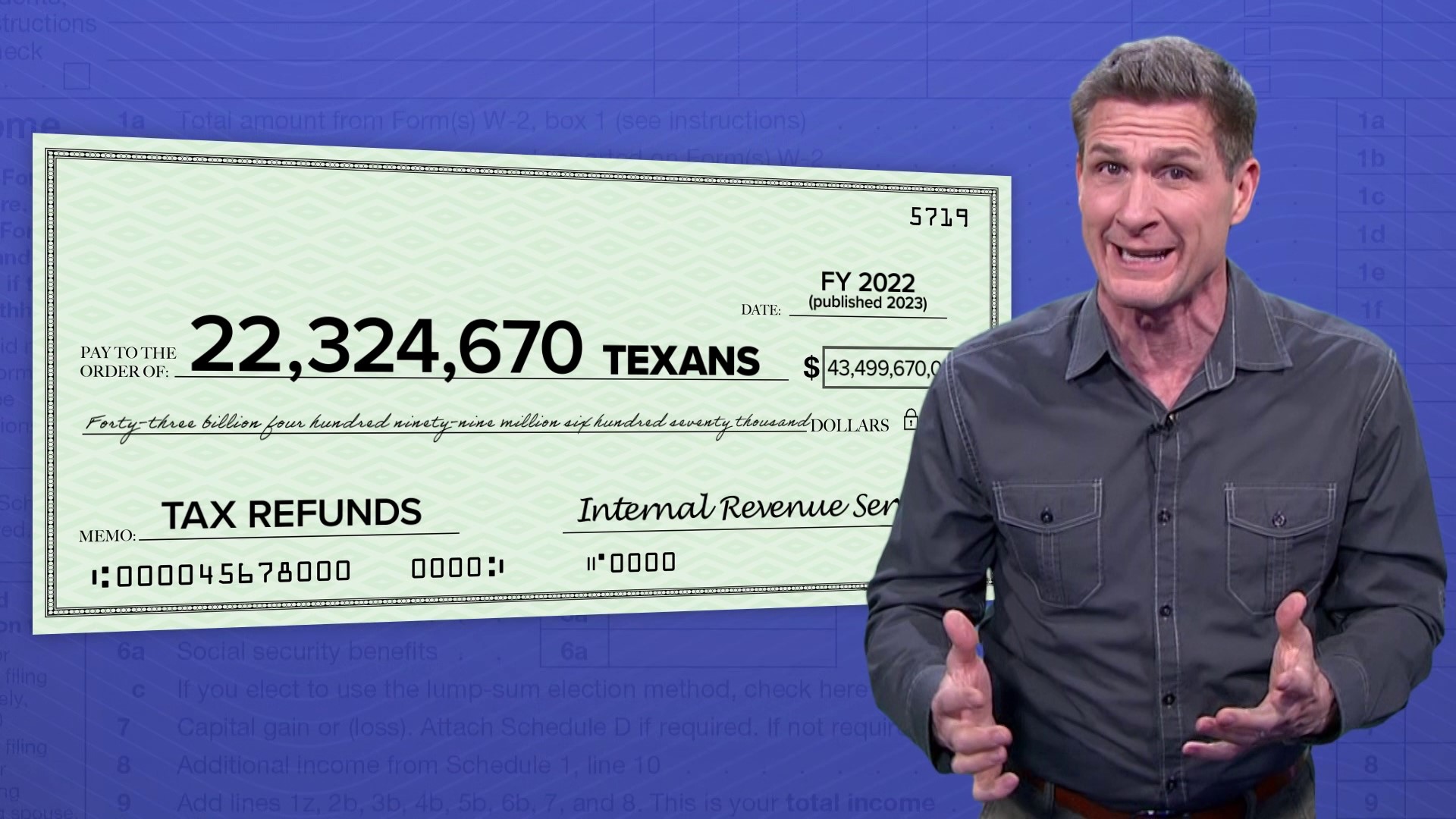

The report showed that in that one year, there were 22,324,670 tax refunds given in Texas totaling $43,499,670,000. You can see that in tables 7 and 8 here.

I felt so left out, but it was my own doing. That’s because I try to tweak my withholding to send just enough in taxes bi-weekly, so that I receive the maximum amount of my paycheck, instead of overpaying and waiting for the government to hand it back to me in a lump sum each year. So, at tax time I usually end up owing the IRS a little.

So this time of year I feel lonely and envious, especially when I see this GoBankingRates report published by Yahoo Finance. It reveals that Texas taxpayers averaged a $1,949 refund in fiscal year 2022, the third highest in the US.

Congrats if you got a refund. And extra kudos if you can avoid being audited.

As much as we worry about tax audits, statistics show that less than one percent of individual tax returns are pulled for a dreaded closer look.

But Intuit’s Turbo Tax raises several of the most likely red flags that could make you an audit target, including failure to report all your sources of income. They warn that the IRS usually gets a copy of all the tax forms that you get. Don’t try to hide income. And don’t forget about income—the Turbo Tax report especially recommends you remember form 1099s and distributions from college savings accounts to pay tuition.

Another red flag they list: Earning more than $200,000. Turbo Tax adds details from last year, saying that the IRS audited about 1% of people earning less than $200K, compared to the almost 4% who brought in more than that and were audited. They add that if you made a million dollars or more, that audit rate went up to 12.5%. A longer list of potential audit red flags is offered by Kiplinger.

A better customer experience with the IRS this year?

Regardless of your income, if you have issues that necessitate contact with the IRS this year, hopefully it will be easier to resolve. During the pandemic, IRS offices closed, most people couldn’t get through by phone, and paper piled up at closed offices and created huge backlogs.

This year the agency aims for a five minute average phone wait time and the ability to just call you back if it looks like you’ll wait more than 15 minutes.

The IRS also notes it is eliminating paper. The agency says taxpayers can now digitally submit correspondence and responses to IRS notices. Before, a lot of that was on paper that had to be mailed, which greatly slowed down processing.

And there is a reported update to the most popular IRS tool: The Check your refund button. It has been enhanced to give more detailed info online or on mobile devices. Before the adjustment, that site was mostly just able to say, ‘Your return is still being processed–check back later’. Now it can tell you if there is a snag with your return.

On the subject of taxes…a cautionary tale

I want to share a message I recently got from a man named Douglas. He says he withdrew money from a CD (certificate of deposit) that had matured, and he invested it in another bank CD.

A lot of people have been doing that because CD interest rates have been relatively high. Side note: If you are thinking about a CD, here are some recent write-ups about rates, courtesy of Forbes and NerdWallet.

Douglas says the problem is that the CD he withdrew was an IRA CD, which has tax advantages. Because of that, you only get 60 days to put that into another tax-advantaged account or pay taxes and penalties on it.

Well, the 60 days had elapsed, and Douglas didn’t realize it was an IRA CD until he got the tax form that showed it. He says the IRS advised him to file for a waiver for missing the window.

But he says the bank where he had reinvested the money wasn’t so helpful. To close the new CD, Doulas reports that he had to pay a penalty equal to all the interest he had accrued, plus $1,650 dollars of his principal. That was an expensive lesson…and a reminder to us all to be very careful when moving any kind of retirement account.

Don't forget, the deadline to file your taxes is April 15th!