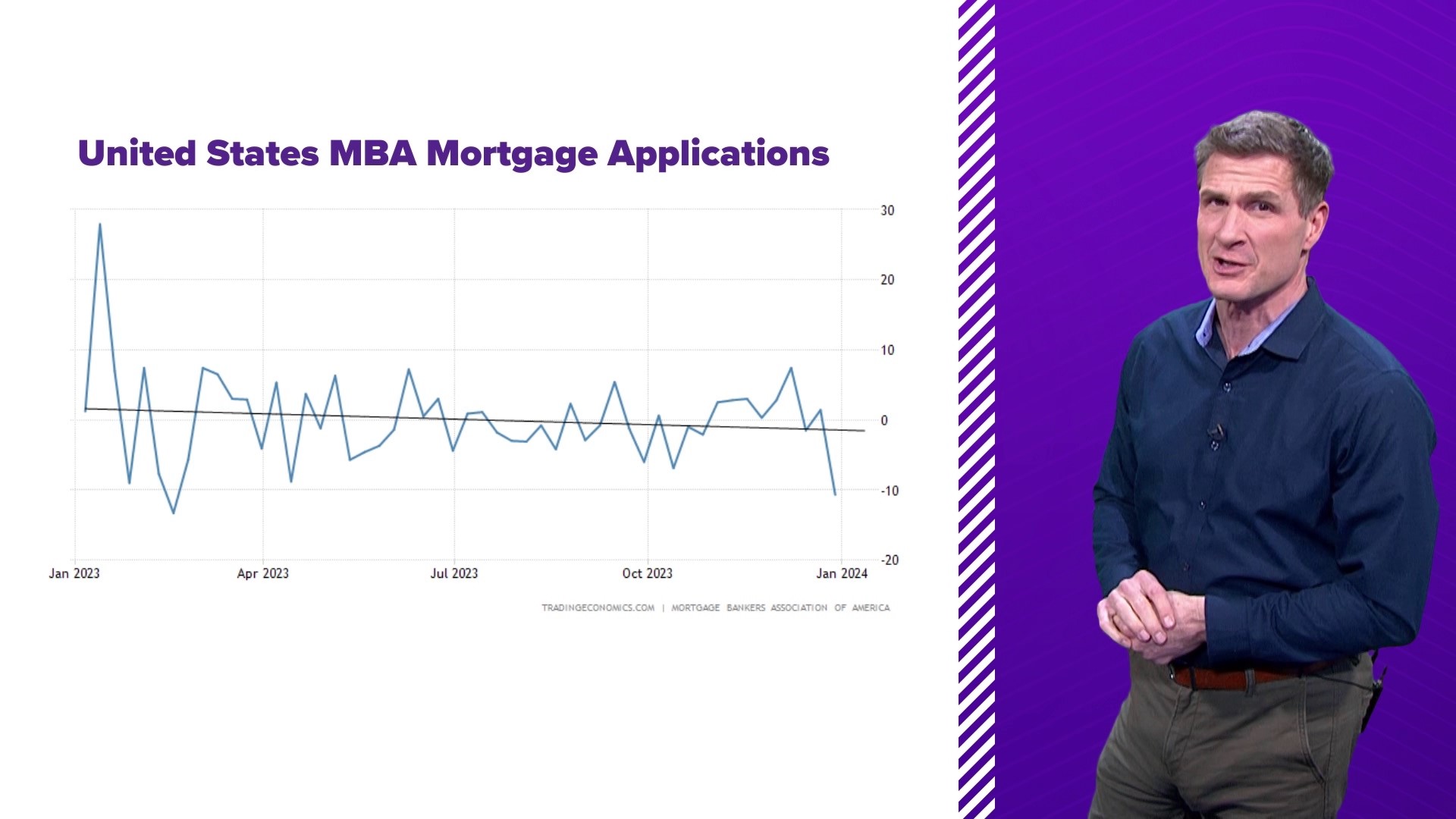

DALLAS — How do you illustrate homebuyer frustration in a chart? For many, it may be as simple as sliding this mortgage rate chart to reveal the rate rise in 2023. This chart might also be helpful for illustrating homebuyer frustration. It shows mortgage applications falling off sharply last year as rates rose.

Median home prices in Texas also continued to surge in 2023. The higher home prices plus higher costs to borrow equaled this Reuters headline in late 2023: U.S. mortgage application flow plunges to lowest since 1995.

If this is triggering some of you, we can take a break from the harsh reality facing many home shoppers and visit an entirely different world for a bit.

The housing market of the rich

In this fantastical real estate market, you are surrounded by the finest of everything. There’s space to stretch out and live ‘the life’ and perhaps not even care at all about mortgage rates. Thing is…staying in a home in this world will cost more than most people will make in a lifetime.

We get to this exclusive home market via the 2023 Compass Ultra-Luxury Report, which details the sales of properties that go for $10 million or more. As you might imagine, there are many places across the country where these high-dollar sales are much more common than they are in Texas.

For instance, the report showed in the top market, Manhattan, there were 256 ultra-luxury properties sold for a combined $4.92 billion in 2023. That was followed by Greater Los Angeles with 231 sales for a combined $4.35 billion and Miami with a total $2.11 billion spent on 118 ultra-luxury properties in 2023.

As impressive as those figures are, fewer $10 million-plus transactions happened in 2023 in those top three markets and in most other markets in the report.

More high-dollar homes selling in Houston and Dallas

But two Texas metros that are much further down the rankings notched an interesting trend. The number and overall total dollar figures for homes $10 million and up in DFW (eight sales totaling $104.01 million) and Houston (seven sales totaling $78.08 million) shot up sharply from the year before (when each metro had just 4 such sales, totaling $46.15 million in D-FW and $65.25 million in Houston).

Moreover, the 2023 numbers for each metro were higher than any of the years listed in the report, which recorded data going back to 2020. Austin was off just a bit in 2023, with three of the mega sales totaling $34.4 million last year, down from four sales for a total of $44.95 million in 2022.

If you are crunching those whopping price tags and mortgage rates and wondering what kind of monthly payment that might come to, that’s not really a thing in many of these cases. Agents with Compass noted a, “Marked increase in all-cash sales”.

And for perspective, these sales numbers are just a fraction of the activity in the extra-tony real estate niche. The Compass team in Dallas points out that increasingly, these high-dollar homes are sold in the private market, meaning they are never listed, and we don’t see pricing or sales data.

In fact, the Compass team says in Dallas alone, there are, “as many as 20 ultra-luxury homes currently available off-market.” So, just right now in the upper-price ‘hidden market’ in Dallas, there are 2.5 times as many $10 million+ homes for sale as sold in the city in all of last year.

First-time buyers in Texas are feeling a real pinch, but there are a few programs that may help some

So…back to reality. For many homebuyers, the affordability frustrations that came to a head in 2023 have been building for many years.

The American Enterprise Institute reports that it analyzed five million first-time homebuyer sales in 60 of the largest metros across the country between 2013 and 2022, and then published the findings.

Their analysis includes a scatter plot that shows home prices have been going up faster than wages. Some Texas metros ended up in difficult territory on the graph.

AEI also calculated the change in home affordability for first-time buyers. Looking at DFW, Houston, Austin, and San Antonio, they determined that in 2013, the median home for a first-time buyer cost between 2.49 and 2.85 times their median annual income.

By 2022, the price of a median home bought by a first-time buyer in those cities had soared to 3.55-3.81 times their annual median income.

Credit Karma last year ranked Texas as the 39th best (also known as 12th worst) state for first-time buyers. The site reported that some states have up to a dozen programs to assist those buyers.

In Texas, there are just a few such programs. But they may help you if you are a first-time buyer. And in some cases, they can even assist you if you are a repeat buyer who hasn’t owned a home in the last three years.

The main programs are “My First Texas Home” and “Home Sweet Texas Home”. I have reported on these before. See more information and links for both programs by clicking here.