DALLAS — First, an important note about property appraisals for people over 65.

Property appraisals are being sent to home and business owners in Texas. Many senior citizens have been lamenting that they have to pay school taxes.

The Texas Comptroller reminds property owners that there is some relief for people over the age of 65 and for people with disabilities. If you are 65 or older, you do still have to pay school taxes, but many appraisal districts give seniors a break.

You may have to ask for it, though.

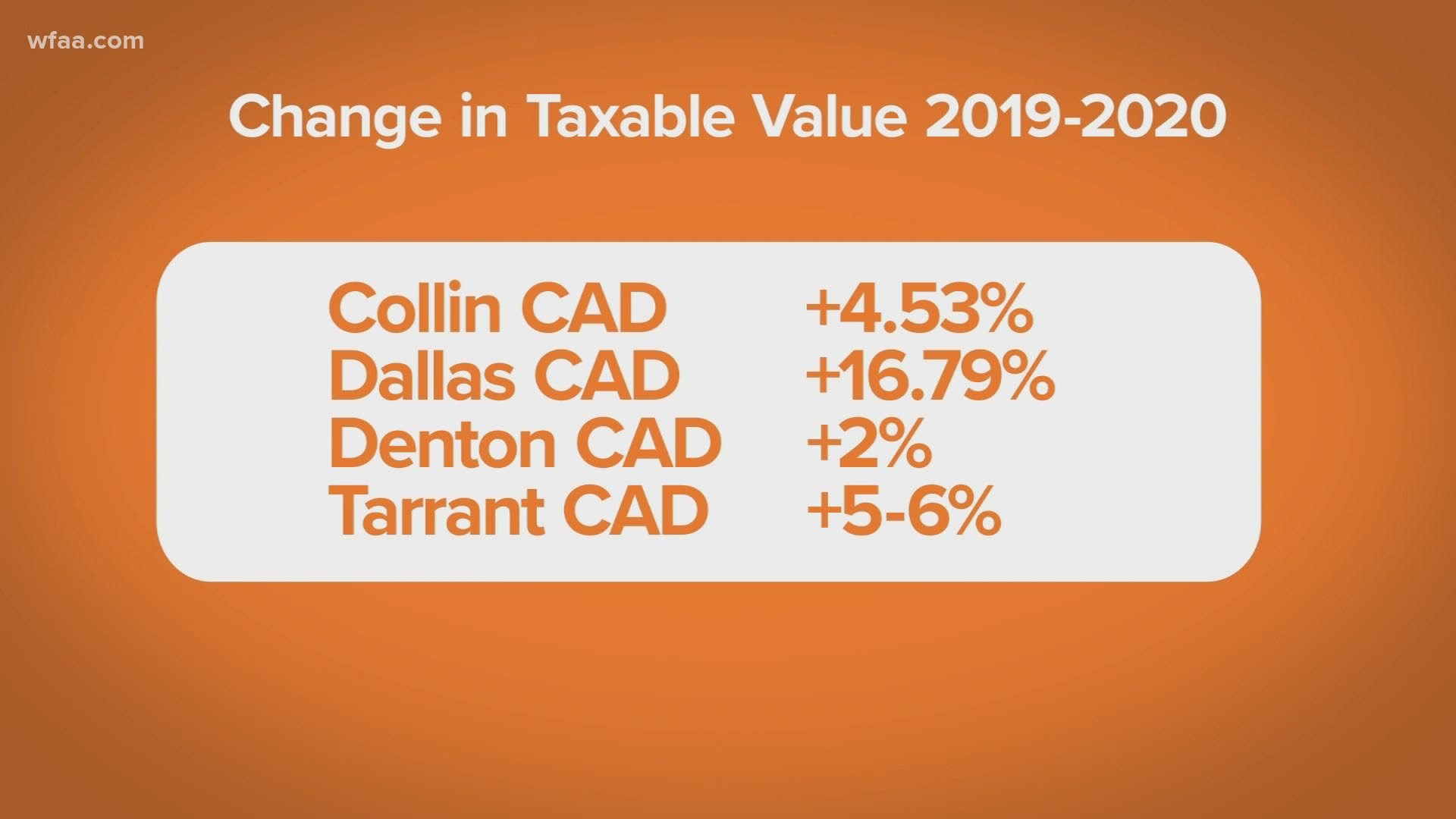

So, contact your appraisal district. Here is where you can find info for the four largest CADs in North Texas:

Unemployment: New numbers and additional benefits for Texans

There are a lot of numbers in this edition of Right on the Money. Another 134,381 Texans filed for unemployment benefits last week.

We are now over 2 million claims since the pandemic began. But this is the 4th straight week that unemployment numbers have ticked down.

The Texas Workforce Commission just started paying out the extra 13 weeks of benefits called the Pandemic Emergency Unemployment Compensation (PEUC). This is for people who have already exhausted their usual 26 weeks of unemployment benefits in Texas.

To date, TWC reports it has already paid $16 million in those additional benefits. That number will rise dramatically in the weeks to come as more Texans become eligible for PEUC benefits and claim their payments.

**Look for the very important note about these benefits below.**

Many people have asked why the popular $600 per week federal unemployment benefit isn’t retroactive all the way back to January 27, 2020. That date is mentioned in the CARES Act referring to Pandemic Unemployment Assistance (PUA), which expanded who was able to get unemployment benefits (for instance, self-employed and gig workers).

The $600 benefit is made possible by the Federal Pandemic Unemployment Compensation (FPUC), which is a separate part of the CARES Act. That section allows for agreements between the federal government and individual states to process the federal weekly benefits payments of $600.

And TWC explains:

“Texas enter(ed) into an agreement with the Department of Labor with regards to Federal Pandemic Unemployment Compensation and Pandemic Unemployment Assistance on March 28, 2020.

"The earliest week the $600 will be paid is for the week ending April 4, 2020; the first payable week under FPUC is the week ending April 4, 2020, based on TWC signing the agreement before March 29, 2020.”

More of your unemployment benefits questions answered

Here are some additional questions people have asked that the TWC provided answers for to WFAA:

1. Will someone receiving the extra 13 weeks of unemployment (PEUC) also receive the additional $600 per week in federal benefits?

FPUC provides $600 per week to any individual eligible for any of the Unemployment Compensation programs (including PEUC) between the week ending April 4 and the week ending July 25, 2020.

2. Do the 13 weeks of extended benefits (PEUC), for people that are now eligible, begin from the time their UI benefits were exhausted or would they begin the week ending April 4, 2020? For example, if your benefits were exhausted on February 1, 2020 and you are still unemployed and have been since that time, would the additional 13 weeks of benefits be back dated to begin on February 1st?

The first payable week for PEUC is the week ending April 4, 2020. The last payable week is the week ending Dec. 16, 2020.

**IMPORTANT NOTE ABOUT PEUC BENEFITS**

The TWC has been notifying people who originally filed unemployment claims from now all the way back to July 2018, and then exhausted their regular 26 weeks of unemployment benefits that they may now qualify for the additional 13 weeks of benefits.

Those 13 weeks of additional benefits would not be backdated to when you exhausted your benefits. They would be backdated to the week ending April 4, 2020. That is significant, because it means those additional 13 weeks come with the additional $600 per week on federal benefits.

3. If a person receives money from their employer through a PPP loan, but they did not “work,” would they be required to submit that monetary amount when requesting payments?

The claimant is required to submit wages earned from the time period they are requesting payment, this includes money paid to the claimant by an employer.

4. If someone received money from their employer through PPP but did not physically work, when requesting payment and submitting the wages earned, should they put in zero for the hours worked?

Yes, and they must report gross earnings (before deductions). This is considered wages.

5. Does the weekly benefit amount and the remaining benefit amount listed on the UBS system reflect the additional $600 weekly benefits from FPUC?

Yes.

6. If a person is notified that payment was sent either through direct deposit or a debit card, and they don’t receive it, what should they do next?

Once TWC releases payment, it takes two to three business days for the payment to show up in your bank account or TWC debit card account.

If your payment does not show up in your bank account, go to Unemployment Benefits Services and verify that your bank account name, bank routing number and account number are correct under Change Payment Option. You can also verify the information using Tele-Serv at 800-558-8321.

If the account information is not correct, you will need to select “Change Payment Option” and correct the information. You can also correct the information on Tele-Serv at 800-558-6631.

It will take eight banking days for TWC to verify your account information after you change it. In the meantime, you will need to contact your bank and ask them to return your payment to you or deposit in the correct account.

You can call TWC’s Tele-Center at 800-939-6631 and ask for help getting your payment back if it went to the wrong account or a closed account. TWC may or may not be able to help.

If the information is correct and it has been more than two to three business days since TWC released the payment, call their Tele-Center at 800-939-6631 and ask them to investigate what happened to your payment.

If this is your first benefit payment using direct deposit and you recently selected direct deposit as your payment option, it takes eight banking days for TWC to verify your account information with your financial institution. If your payment is released before the 8 days are up, we may pay you by check. Watch your mailbox.

If this is your first benefit payment by debit card, and you do not already have a TWC debit card, U.S. Bank mails you your debit card on the day after TWC releases your first payment. U.S. Bank mails your new debit card in a plain white business envelope and it takes about 10 business days to arrive. Once it arrives, read the accompanying material and activate your card immediately. The payments should then show up in your account.

If you already had a TWC debit card and the payment is not added to your debit card account, call U.S. Bank’s customer service department at 800-657-6343 for help.

If you had a previous claim with TWC and had an overpayment, TWC may keep some or all of your payment to pay off your overpayment. The payment may show as paid in payment status, but you do not directly receive the payment. Call TWC’s Tele-Center at 800-939-6631 to discuss the reason for the overpayment.

More Right on the Money:

- How to protest your property tax appraisals

- Virtual job fair in Dallas will feature almost 40 companies who are hiring

- Some will be exempt when work search requirements resume for Texans on unemployment

- Dallas-based accounting firm CEO offers advice on PPP loans

- How a Dallas company is helping the PPE fight

To read even more of Jason Wheeler's Right on the Money reports, visit wfaa.com/rightonthemoney.