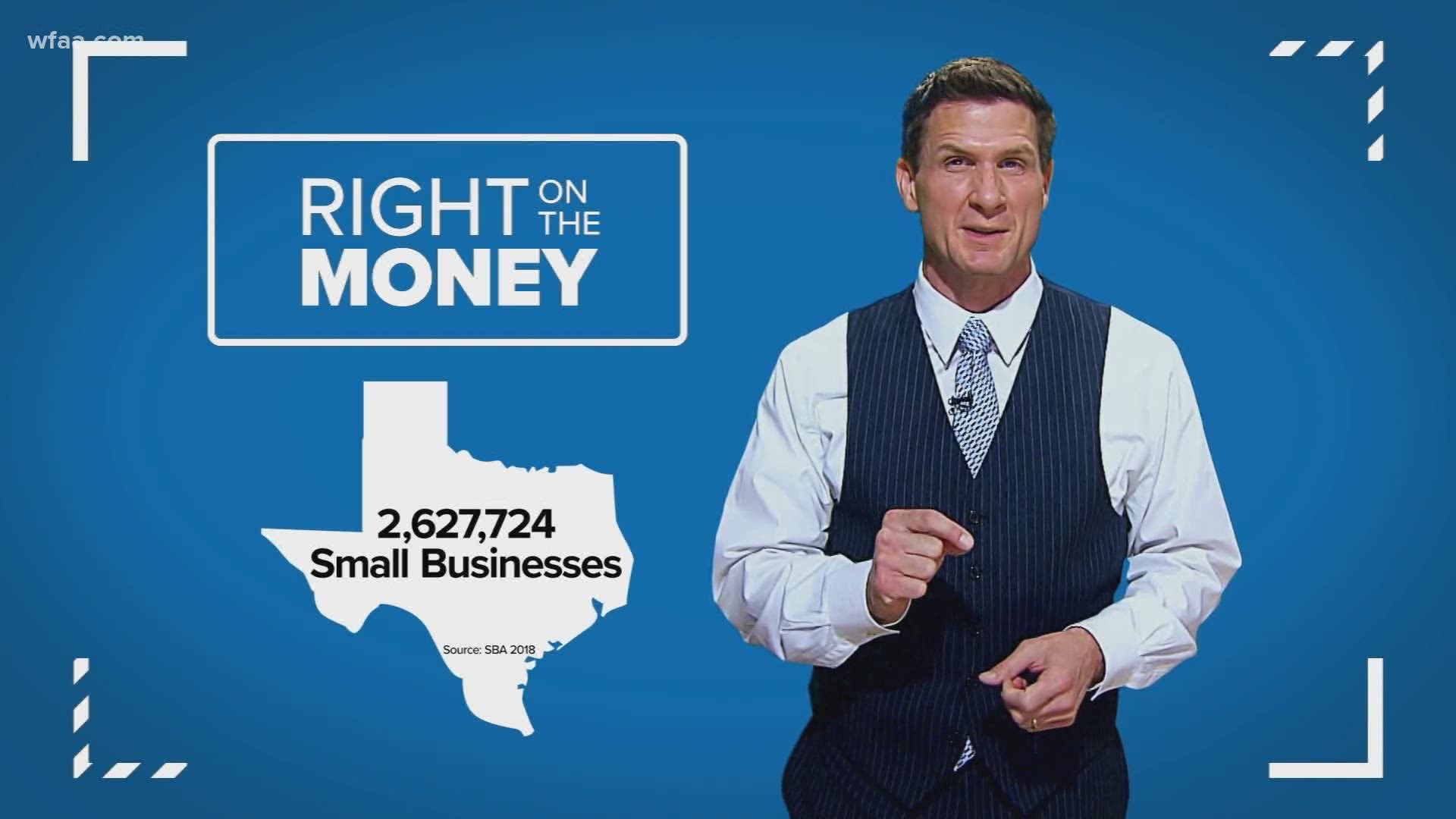

DALLAS — Texas is home to more than 2.6 million small businesses, according to 2018 data from the Small Business Administration. More than 100,000 Texas businesses have recently taken advantage of the Paycheck Protection Program, or PPP.

There have been two rounds of funding for the program, totaling more than $650 billion. About $122 billion remains in the fund, which provides loans that can be forgiven if the money is primarily spent to keep workers on the payroll.

Note to workers:

If your employer gets money through the program, here is how that affects your unemployment benefits through the Texas Workforce Commission: If you return to work full time you no longer qualify for unemployment. If you go back to work with reduced hours you could still qualify for benefits.

RELATED: Frequently asked questions and answers for small business owners thinking about a PPP loan

RELATED: This calculator helps estimate how much of a potential PPP loan could be forgiven, and how much you may still owe

If you’ve already gotten one of these loans and have had second thoughts, you can return the money -- no questions asked -- by Thursday, May 14. That information is included in the frequently asked question link above, items No. 43 and 45.

Why would a business give back what could essentially be free money?

These PPP loans can be more complex than business owners were expecting.

Ford Baker, CEO of Dallas-based accounting firm BaCo Group, says many business owners apply for the loans by estimating their needs over a two-month timeframe. But the loan forgiveness is actually calculated based on eight weeks of expenses.

“Technically there are 56 days in 8 weeks and there’s 61 days in two months. You’re going to have five days that miss a rent payment in there. You may miss an entire payroll," he said.

This could leave businesses scrambling to cover payroll even if they receive funding, Baker says. The key is for businesses to plan ahead and work closely with their accountants to gather the right information and update schedules.

"So, is my weekly average going to be enough to cover what I had planned on in a monthly average format, or am I going to have to accelerate payroll or do something to try to make sure my eight-week average reflects what happened?" said Baker.

Advice for businesses who have already gotten PPP loans

Baker says his firm has helped many small businesses through the PPP process. He has some advice for those business owners who have already received the funding:

- Don't assume your accountant or advisor has the details. One of the things Baker says has been scary about the process is that business owners think that accounting firms have all the details of the payment once they are involved in the process. Baker says there really isn’t anything in place that would notify him an eight-week calendar is starting for this particular business today.

If the business emails saying ‘Hey I just found out today that got the loan funded,’ the accountant won't know if that means that it was funded today or if the business owner found out today, but it was funded earlier. They need key details such as amounts, dates, etc., to help businesses manage the process. - Funding could bump up against the new tax deadline of July 15. Another thing business owners in the second round of funding may run into: their eight weeks is going to end at the end of June or beginning of July. And the tax filing deadline to July 15. Baker says that may create a real crunch as CPAs rush to get their clients’ taxes filed just as an important deadline is hitting with many of their clients’ PPP loans.

He also knocks another piece of common advice that business owners should set up a separate bank account to manage the PPP funds:

- How do I make sure that only the payroll that is under $100,000 comes out of this account? Or if I fund payroll through a payroll service, I am going to have one big draft of it that is not going to be all of it? Baker says he doesn't know that it is worth all the maneuvering that it would take to get the payroll drawn out of two different accounts, to draw checks out of those accounts, etc. It makes sense on the surface, he says, but it’s just another change to add when there are going to be a lot of changes with this.

Baker says it is really important to communicate with your accountant throughout the process, and carefully document everything.

- Don’t expect this to be business as normal with a CPA. Don’t expect to just unload stuff on him, says Baker. If you don't record a deposit on the day it came in because you didn’t know what to do with it, then he doesn’t have a way check on things. So, be ready, be current, keep everything up to date. That will keep your CPA in the loop.

- Expect change and challenges. The PPP is a government program that will likely come back with some oversight, Baker says. He recommends as businesses gather documents together, not to put everything behind the document.

Business owners should have everything ready to readily support that this was a legitimate expense. Have documentation that it existed, meets all of the time frames, and you paid it on time. By keeping that in one place, Baker says, if something is challenged you can easily answer and get them back what they need.

Advice for businesses applying for or considering a PPP loan

For those firms still going through the process of applying for PPP loans, or those planning to apply in the event of future PPP funding, Baker advises:

- Plan ahead. The day you get the funding, an eight-week clock starts during which you have to spend the money. You will be the only person who knows that money came in and when that eight weeks ends.

- Be ready. When you submit an application, assume that they are going to ask for the same information again. If something was wrong with a previous submission, fix and resubmit it as soon as possible.

- Keep it simple. If the bank says I need these eight documents, give them those eight documents. Don’t give them long explanations, send extra documents, or give them hundreds of pages. Be as simple as possible. Have the answer right on top so it’s easy to see your calculation and that everything is supported. And if anything is unusual, don’t make it stick out. Just include it in the workflow and if it’s something that is wrong, we can always come back and address it and pay the loan back.

- And most importantly, be nice. Your bank is dealing with a ton of applications and this has thrown every control they have into chaos. Expecting them to automatically get something or expecting them to handle it easily will get frustrating. So be nice, be thankful, be grateful even if you don’t get good news, because it’s not going to be the person on the other end of that phone call or email who is responsible for it.

COVID-19, PPP loan process tests new accounting program

Baker says the current situation has tested a new program he created under the name BaCo Tech.

“This is a brand-new technology we are really excited about because it worked with this crisis. It creates a standard workflow that is not just a bow on it when the CPA needs it," he said. "It brings it in real-time every night. It identifies things we can do during the year to get ready for the end of the year.”

BaCo Tech is currently onboarding other CPAs interested in using the platform.

Will Baker, who was ran a small business prior to joining the firm as Marketing and CPA Experience Director, explains the benefits of it.

“I was never concerned with filing deadlines…I was concerned with what I was doing. I was working. I was running my business. I was trying to maintain profitability," said Will Baker.

He says the platform helps close the communication gaps between business owners and CPAs. Will Baker says when he was running a small business, he didn't know the difference between a balance sheet and a trial balance.

"That’s was not something that was in my vernacular of what I did as a business guy. I didn’t know what I didn’t know. It ended up with frustrated communication gaps," he said.

BaCo Tech helps by gathering the information from the business owner and passing it along to the CPA.

"And it eliminates the frustrations business owners feel. Business owners get really frustrated by surprises---like I owe how much? And I am finding out on April 14. That’s frustrating,” said Will Baker.

Kaitlyn Kirkhart, the CCO at BaCo Tech, adds that this technology eliminates the last minute rush as a deadline approaches. She said they used to get emails, mail, phone calls and even text messages of documents and spreadsheets as a deadline neared.

"That’s where BaCo Tech comes in. It eliminates that for business returns by delivering everything in one place automatically in a consistent format to integrate directly into a CPA’s workflow," she said.

How the Paycheck Protection Program has worked so far

The PPP has been a lifeline for a lot of small businesses during an unprecedented economic challenge. But the program has also been heavily criticized for various reasons. Ford Baker, however, said he doesn’t have anything negative to say about the program.

“I would just congratulate people for thinking outside of the box and getting something funded really quickly," he said. "To start trying to say I want to second guess what happened or would there be a better way of doing it…it’s all counterproductive. This is what we’re in for. Let’s see it through.”

Ford Baker says he's seen firsthand how helpful the program has been for many businesses. He got emotional talking about how crucial small businesses are to the economy and to people who count on those businesses for jobs.

He said for businesses in the travel or event industries, the coronavirus pandemic has been incredibly damaging.

“There is likely not an event with more than 10 people that is going to occur within the year. And if your entire revenue stream is built on gathering hundreds or thousands of people and managing that event, you have lost revenues for an entire year," said Ford Baker. "Your whole life may have been built around, 'this is what I want to do.' It’s tough."

Ford Baker says BaCo Tech is what he wants to do and he thinks about the impact on himself and others as he runs his business.

"Every time I have ever hired somebody, the first thing on my mind is, 'can I afford another mortgage?'" said Ford Baker. "There is a family out there that is depending on me to make the payroll for the next couple of years and there is going to be a mortgage company that issues a loan off my W-2, so there is a big responsibility that we have as a business owner. The people who are working for us…we are taking care of all of them”

RELATED: From Forbes: 10 things small businesses need to know concerning SBA loan programs

More Right on the Money:

- How a Dallas company is helping the PPE fight

- If you sent in a paper tax return, it might take longer to get a refund

- How to get up to 13 more weeks of benefits from the Texas Workforce Commission

- How online ordering has saved Dickey's Barbecue Pit

- Realtor speaks about what coronavirus has done to the housing market