DALLAS— A retired Dallas cop found herself swimming in a sea of red tape when she looked to pay for almost $20,000 in plumbing repairs with money she saved while wearing the badge.

Over the past several years, first responders in Dallas have been through a rollercoaster of emotions when it comes to their retirement funds.

In 2016, the city started scrambling to save its pension fund for Dallas firefighters and cops.

The fund was on a crash course to insolvency. Years of risky real estate investments and overly-generous benefits put the fund in the hole by the billions. It took legislative action from the state for the fund to finally be reformed and put on the route to salvation.

However, many retirees are still feeling the brunt of the mismanagement.

To keep tenured cops and firefighters around, the city started offering a Deferred Retirement Option Plan (DROP) in 1993.

DROP allows first responders to place their pension payments in a DROP account and accrue interest on those dollars while they keep working.

Once retired, retirees could withdraw money from their DROP accounts with practically no questions asked on top of their monthly pension checks.

If they asked for a sum of money by 5 p.m. Tuesday, they could get it by the end of the week on Friday.

Before state lawmakers got involved, some retirees were pulling six-figure, and in some cases seven-figure payments out of their accounts.

Now, retirees get a percentage of what was in their DROP accounts in a stream of payments either monthly or annually.

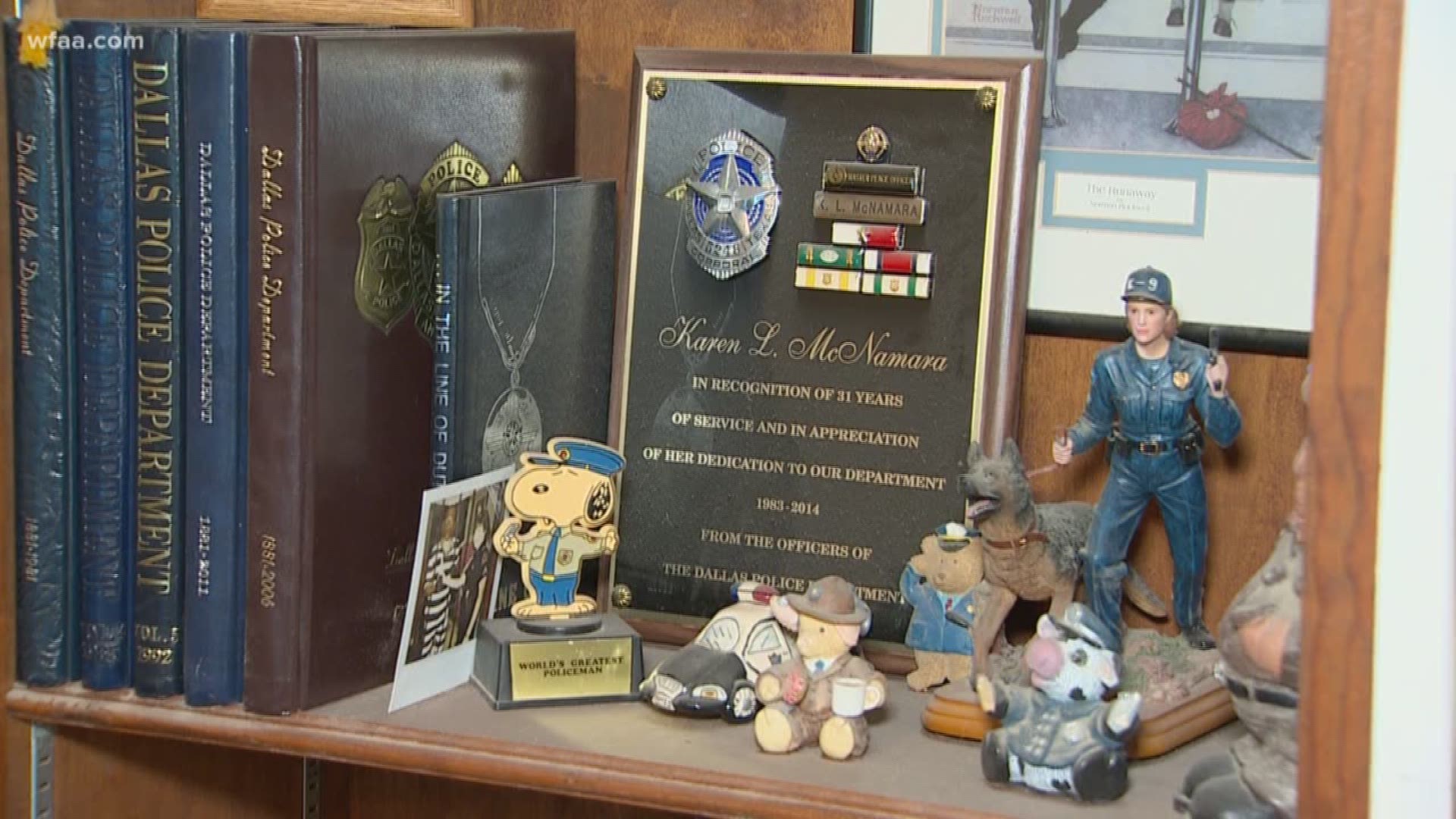

Karen McNamara says she had more than half-a-million dollars in her DROP account. The DPD retiree spent 31 years with the department, and primarily trained new officers in the academy before she retired in 2014.

For McNamara, she remembers once touting the department’s pension plan as the best around. “That was one of our major pushes during recruitment,” McNamara said.

McNamara receives her DROP check along with her pension check monthly.

But when her home, built in Irving in 1962, recently needed all its plumbing pipes replaced—she wanted to withdraw more from her DROP account to pay for the repairs. McNamara said that her insurance company wouldn’t cover a bill that totaled $18,700.

“$18,000, I mean that’s huge for me. It’s huge for anybody,” McNamara said.

The Dallas Police and Fire Pension System still allows for DROP retirees to pull money from their accounts, but it can only be for emergency purposes or an unforeseen event.

Eligible circumstances include repairing property not covered by insurance due to a natural disaster or significant event, the need to make repairs to a residence not covered by insurance because of a medical necessity, unforeseen medical expenses, funeral expenses, or some other extraordinary or unforeseeable event.

There’s a catch, however, an application form shows that retirees must prove they have no other sufficient assets available or any other financial means to pay for the said unforeseen event.

McNamara said she was asked to provide bank statements, 401k statements, and IRA statements.

She said it was so cumbersome and invasive, that she just paid for the repairs using a personal savings account containing less money.

“They want us to be destitute, before they even consider letting us have some of our money,” McNamara said.

Pete Bailey, President of the Dallas Police Retired Officers Association, says the system is broken.

“They shouldn’t have to ask anybody for their own money,” Bailey said. “So she’s having to go ask the pension board for special access to her personal private property—her money. That’s ridiculous.”

Bailey said McNamara isn't the only retiree facing this battle, too.

McNamara said she feels betrayed and hopes the city’s pension system eventually gets back on track. “It feels like the rug was pulled out from under us,” McNamara said.

According to Feldman & Feldman, PC—the Texas Supreme Court will hear a case brought forth by firefighters and police regarding cuts to the pension program.

Bailey said proceedings could get underway later this year.

Kelly Gottschalk, the Executive Director of the Dallas Police and Fire Pension System, told WFAA the fund is projected to be fully funded once again by 2061 if reform efforts hold strong.

That projection is expected to be updated within the next month.