A Trump administration official says income tax refunds for 2018 will go out on time during the partial government shutdown because rules will be changed to make funding available to pay them.

Russell Vought, acting director of the White House budget office, tells reporters: "The refunds will go out as normal. There is an indefinite appropriation to pay tax refunds."

Previous reporting had indicated that while the IRS does conduct some business during shutdowns, it generally does not issue refunds, answer taxpayer questions outside the filing season or conduct audits.

With filing season starting on Jan. 29, about 12 percent of the IRS is expected to continue working through the shutdown, according to CNBC.

The IRS may recall a large number of furloughed employees to process returns — probably without pay — in accordance with its contingency plans. But with the shutdown in its third week, concern was growing that hundreds of billions of dollars in refunds would be delayed until the shutdown ends because funding for them wouldn't be available.

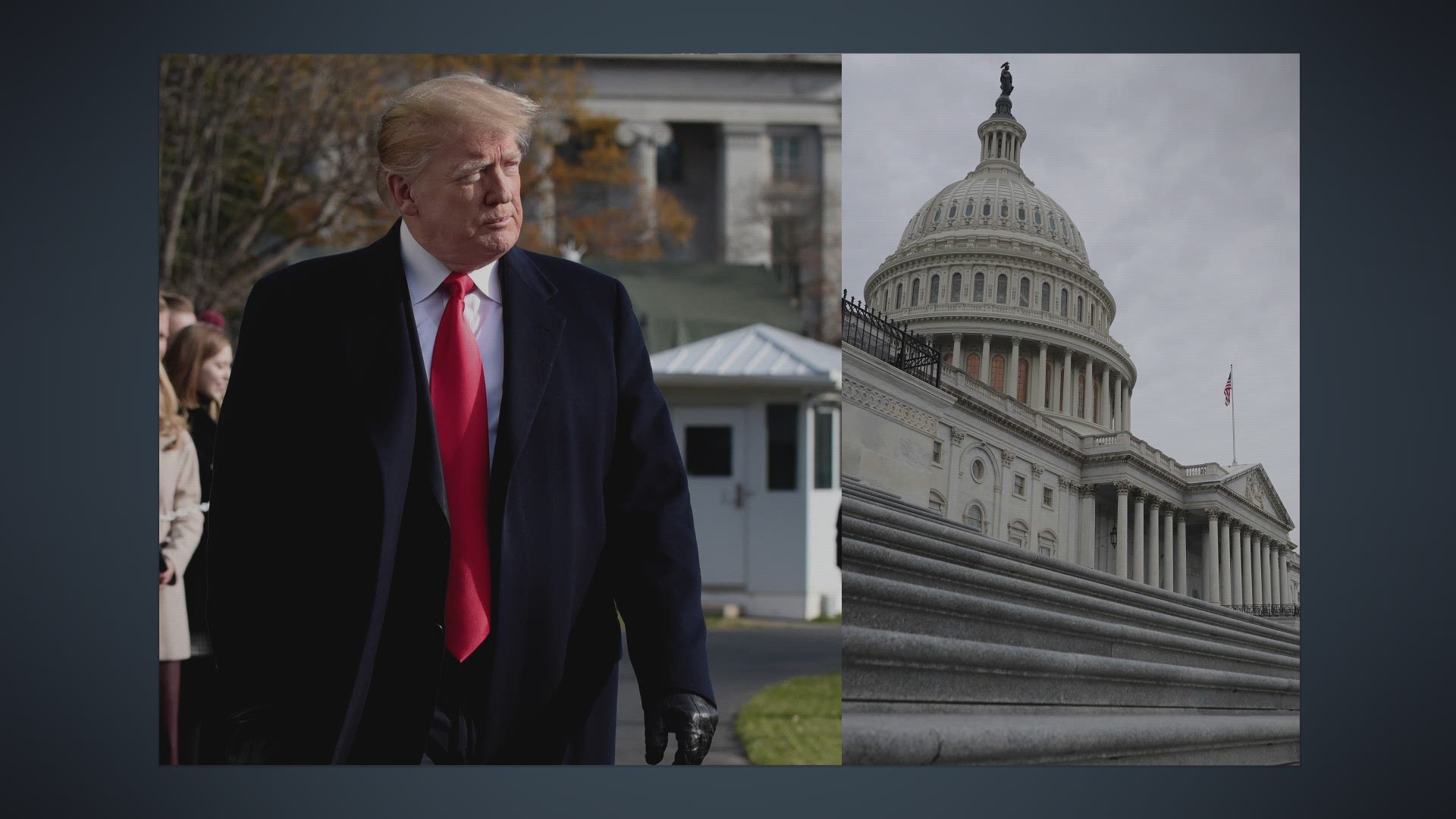

As of Monday afternoon, there has been no agreement between House Democrats and President Trump over his demands for $5 billion for a border wall.

The president tweeted that he plans to “Address the Nation on the Humanitarian and National Security crisis in our Southern Border” Tuesday at 9 p.m. Eastern.

Vice President Mike Pence said Monday the White House is looking into the legality of declaring a national emergency to circumvent Congress and begin construction on the border wall.

Pence also said that the president has invited Democratic leaders Chuck Schumer and Nancy Pelosi back to the White House to continue their discussions.

The Wall Street Journal reported the IRS paid out $12.6 billion in refunds by Feb. 2 of last year.

The Associated Press contributed to this report.