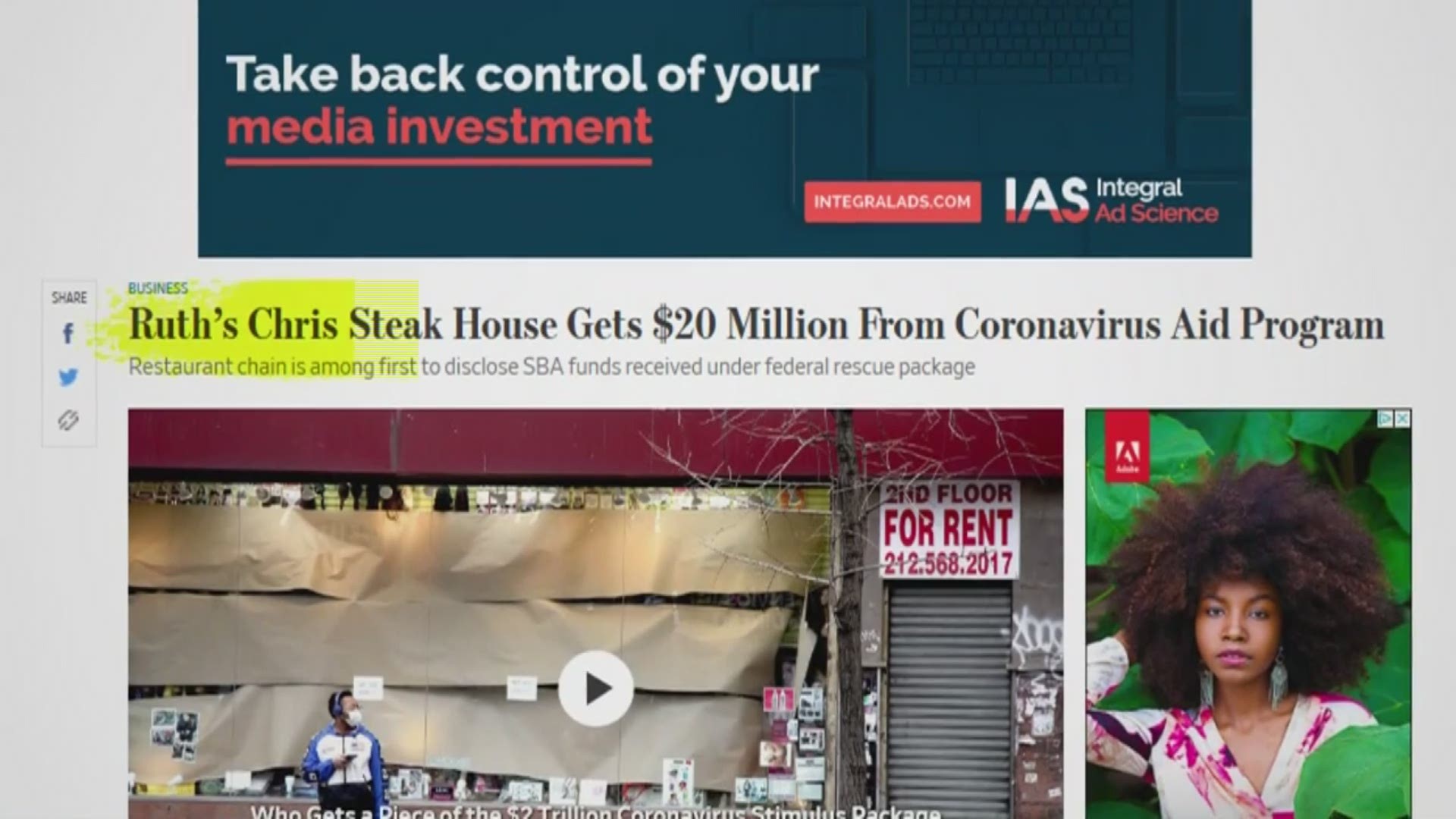

DALLAS — As large corporations announce that they have successfully received loans and grants under emergency programs administered by the Small Business Administration, frustration grows among the smallest of businesses, especially now that the Paycheck Protection Program is officially out of money.

Thursday morning the $349 billion emergency small business lending program ran out of funds, according to a message for lenders posted on the SBA website.

So if you are Emilia Flores, running the Taco Stop on Irving Boulevard in Dallas, Thursday was yet one more frustrating day.

"I think I'm just in limbo until something happens or not happens," Flores said.

Weeks after applying for SBA loans and paycheck protection, she's heard nothing from the SBA or her bank.

Flores' small taco stand, limited now to take out and curb side delivery, is doing only about a third of the business it used to. Much of her normal clientele, workers in nearby businesses in the Dallas Design District, are out of work as well.

"I'm going to keep working as long as I can keep working," Flores said. "But when there's no more money for payroll or for rent or for utilities, what do you do?"

"I can't get anyone to answer the phone," said Wendy Fisher of Good Day Pet Sitters.

Her frustration is the same: no answer from the SBA for the loan and grant programs she applied for weeks ago.

The business for Fisher's staff of 20 has dropped off dramatically as pet owners, no longer traveling for business and/or canceling vacations during the coronavirus crisis, are no longer in need of pet sitting and pet-walking services.

"It's tough to take that's for sure," she said of the reports that major corporations and larger businesses are getting answers and millions from the SBA. "And I don't deny them that they need money as well. But I do feel like they get a priority over us. They know people."

"And I have been hearing about that from folks all across my district. And I'm extremely concerned by it," said Rep. Colin Allred, who joined a bi-partisan group of lawmakers in a letter to SBA administrator Jovita Carranza on Thursday.

"Millions of small business owners are waiting for a response from the SBA regarding Economic Injury Disaster Loans (EIDL) and applications for a CARES Act grant," the letter states, as the members of Congress ask the SBA for information that will help them assist the SBA in meeting its assistance goals. "Based upon the CARES Act's requirement that these grants be distributed within three days, many small business owners have been confused and frustrated regarding the status of their loan and grant application."

"We understand the pain that our small businesses are in," Allred told WFAA.

"We know that every day counts right now. And we are working extremely hard to get the money to them," he said, while also recommending that business owners contact his office for assistance.

As for the little guys, the Taco Stops of the world, they don't know how many days that might be able to hold on, without help.

"I don't think by one more month, if things don't change or business gets back to a little bit like it used to," said Flores. "I don't think more than a month or two, or even a month and a half."

More on WFAA:

- If you haven't received your unemployment or stimulus check, here's what you can do

- Dallas City Council Ad Hoc Committee votes to recommend landlord-tenant COVID-19 ordinance

- 5.2 million more seek unemployment aid as US layoffs continue to spread

- Read this before you raid your 401(k) during coronavirus crisis