DALLAS — Editor's note: This story originally appeared in The Dallas Business Journal here.

Some relief for the North Texas housing market may emerge in 2024, but many of this year’s challenges will likely persist.

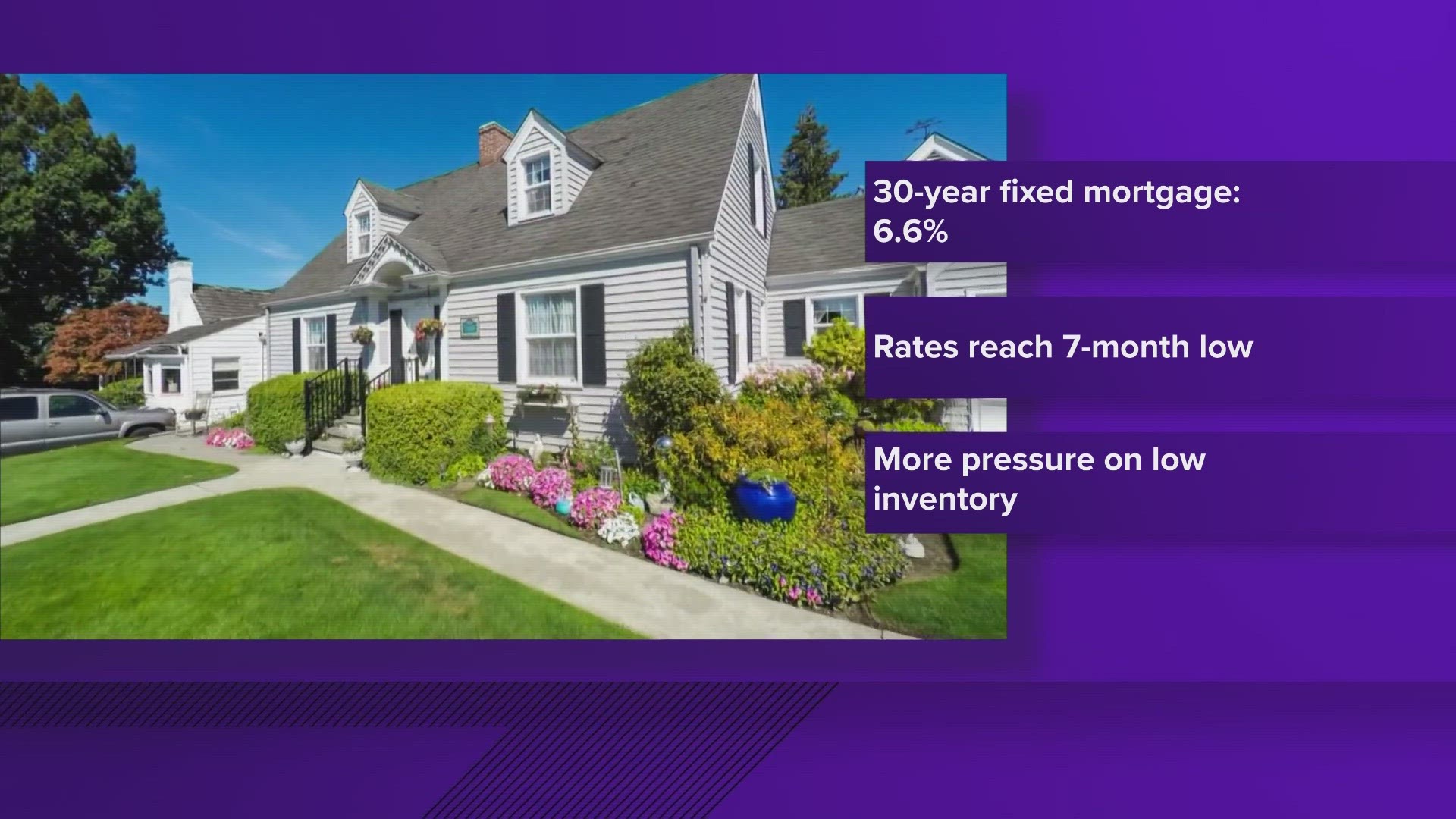

Mortgage rates, which have been climbing since 2022, reached their highest levels in more than 20 years in 2023 while home prices remained near historically high levels as demand outstripped supply. Those factors, coupled with low inventory, will continue to create difficult conditions for buyers in 2024, real estate professionals predict.

A lack of supply continues to hamper most big-city residential markets nationwide, including Dallas-Fort Worth, said Stephen Kotler, brokerage CEO for the Western region at Douglas Elliman Real Estate. Many potential buyers are remaining in their homes, unwilling to give up very low mortgage rates.

“It’s caused this friction in the market where you have decent demand but very little supply because those homeowners don’t feel that they have a place to go if they come out of the home that they’re in,” Kotler said.

That said, Douglas Elliman is seeing some signs that conditions may improve in the year ahead. For one thing, the average rate on a 30-year mortgage was down to around 7% in mid-December, versus closer to 8% a month prior.

“We’ve seen sales volume trending upward,” Kotler said. “I think it’s a feeling that inflation is slowing.”

One recent forecast predicts housing prices and sales in DFW will tumble in 2024. Home prices will drop more than 8% year over year and sales will fall nearly 13%, according to the outlook released in late November by Realtor.com.

That was the fifth biggest predicted price decrease among major U.S. metro areas. Home prices in Austin-Round Rock will plunge the most of any major metro, falling more than 12%, while home sales will slip by nearly the same amount, according to the Realtor.com forecast.

That seems to be the worst case scenario for North Texas. The National Association of Realtors predicts Austin and Dallas will be the markets with the most pent-up housing demand next year.

The latest market data show signs of improvement but leave many big questions. In November in DFW, home sales were down 3.1% from a year prior, according to Re/Max data — the lowest year-over-year drop in 2023. Active inventory hit 21,099, up 9% from November 2022, and months of inventory was up to 3.3. Most experts consider at least six months necessary for balance between housing supply and demand.

In high-end DFW neighborhoods including Highland Park, University Park and Preston Hollow, inventory is especially tight due in large part to houses being snapped up by out-of-state buyers moving to Texas, Kotler said. However, it’s a better market for buyers than it was a year ago, when some luxury homes in Dallas-Fort Worth were attracting 30 offers, he said.

Properties priced at or below $1 million in areas such as Plano and North Dallas are still pulling multiple offers, Kotler said.

“But when you come down into Highland Park and those areas and the prices are somewhere between $2 million and $5 million or $6 million, it’s a little bit slower,” he said.

Rising construction costs and land prices in luxury neighborhoods in North Texas continue to drive up prices on new builds, Kotler added.

“If you’re a homebuilder in those markets and you bought dirt two years ago, your pro forma on that project is going to change a lot and what you’re going to potentially sell it for [will be higher] because the costs of construction have increased dramatically,” he said.

What happens in 2024 will depend largely on interest rates and inflation, and to a lesser extent on geopolitical and other factors, Kotler said. Sales are typically slower in a presidential election year.

“The next year is going to be bumpy,” he said. “I would definitely keep your seatbelt on.”

Danny Perez, managing director of Rockwall-based M&D Real Estate, said housing inventory has improved in DFW over the past year, but will continue to be tight in 2024.

“Right now, 70% of America has a 4% or lower interest rate on their current mortgage,” Perez said. “Inventory is a huge problem. On top of the fact that in DFW we have so many people moving here, and not enough housing, the amount of inventory is an issue because people are staying put instead of selling.”

Perez expects minor price corrections in some pockets of DFW in 2024, but no dramatic declines because of the shortage of homes. Prices will likely hold steady or move slightly higher overall, he predicted.

He said the inventory shortage will likely last a decade.

“We need a huge jump in inventory and it’s not going to happen if can’t build enough new houses,” Perez said.

The shortage of resale homes in North Texas is helping new home sales, said Tom Cawthon, Dallas division president of homebuilder Taylor Morrison, which has active communities throughout the region.

Affordability is the biggest problem in the new home market in North Texas, and that’s unlikely to reverse significantly in 2024, Cawthon said.

“Between the cost of materials, land cost, entitlement cost, development cost — there’s just a real strain on affordability,” he said.

Taylor Morrison, which had an average sale price of about $680,000 this year, will sell homes priced in the low $300,000s in two North Texas communities in 2024: River Ridge in Kaufman County near Crandall and Madero in Tarrant County near Haslet.

“Those will be volume plays,” he said. “We anticipate getting volume in exchange for that price point.”