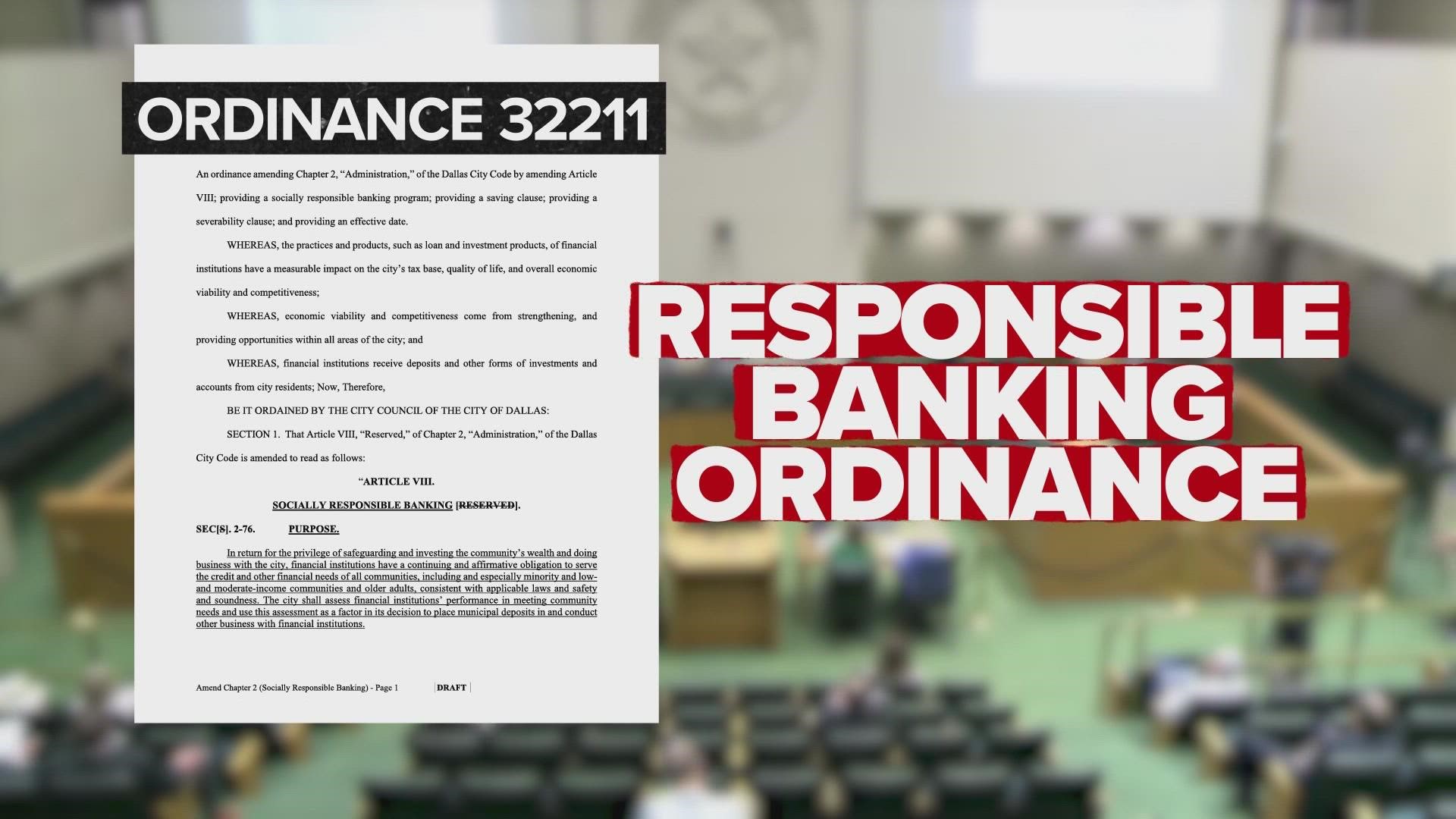

DALLAS — The Dallas City Council accomplished lasting change when, based on WFAA’s reporting, it recently approved Ordinance 3221.

It's better known as a responsible banking ordinance, which holds banks accountable for making loans in minority neighborhoods. It's something federal law already encourages banks to do, but in practice, as we’ve reported, many banks refuse to do.

“I want to thank WFAA's reporting, the Banking Below 30 investigation, which, from my perspective is the genesis of this,” said Council Member Jaime Resendez, who championed the ordinance.

As we've reported, local governments are good bank customers. For example, the City of Dallas deposits more than $250 million in tax money at Bank of America. That kind of money gives local governments leverage to make demands about how a bank treats minority borrowers.

And that’s exactly what the new ordinance does. It says: the city shall "...use socially responsible banking performance as a factor in determining..." who it banks with.

James McGee is an activist who challenges banks to lend more in minority communities. He says what the city council has done is significant.

“On this issue, they did a great job of working together from the council members to the staff,” he said. “I think it was a real team effort.”

What McGee likes is the transparency. Banks are supposed to lend in high-, moderate- and low-income communities. Now, empowered by this new ordinance, the city treasurer is required to shine a spotlight on bank practices by holding a public hearing about how well banks are serving lower income customers.

“I think it provides transparency,” McGee said. “These are the requirements – ‘Now, come show off your good work.’”

Thirteen cities around the country have some form of a Responsible Banking Ordinance. Dallas now becomes the first in Texas, with the City of DeSoto set to vote on a similar measure in October.

When Philadelphia adopted its ordinance, the banks it chose to make deposits with became more active lenders between 2008 and 2018, increasing their share of business loans by 18% in low-income census tracts.

“We're going to have to continue this work because redlining has been around for a long time and it's going to keep moving forward unless we take a step as a city to change the way we do business, holistically,” said Council Member Carolyn Arnold.