DALLAS — A credit card weighs so little. Yet the debt on our collective cards is becoming a heavier and heavier burden. The Fed shows our total credit card debt is the highest since they started keeping track (see the second chart here). We’re almost at a trillion dollars owed.

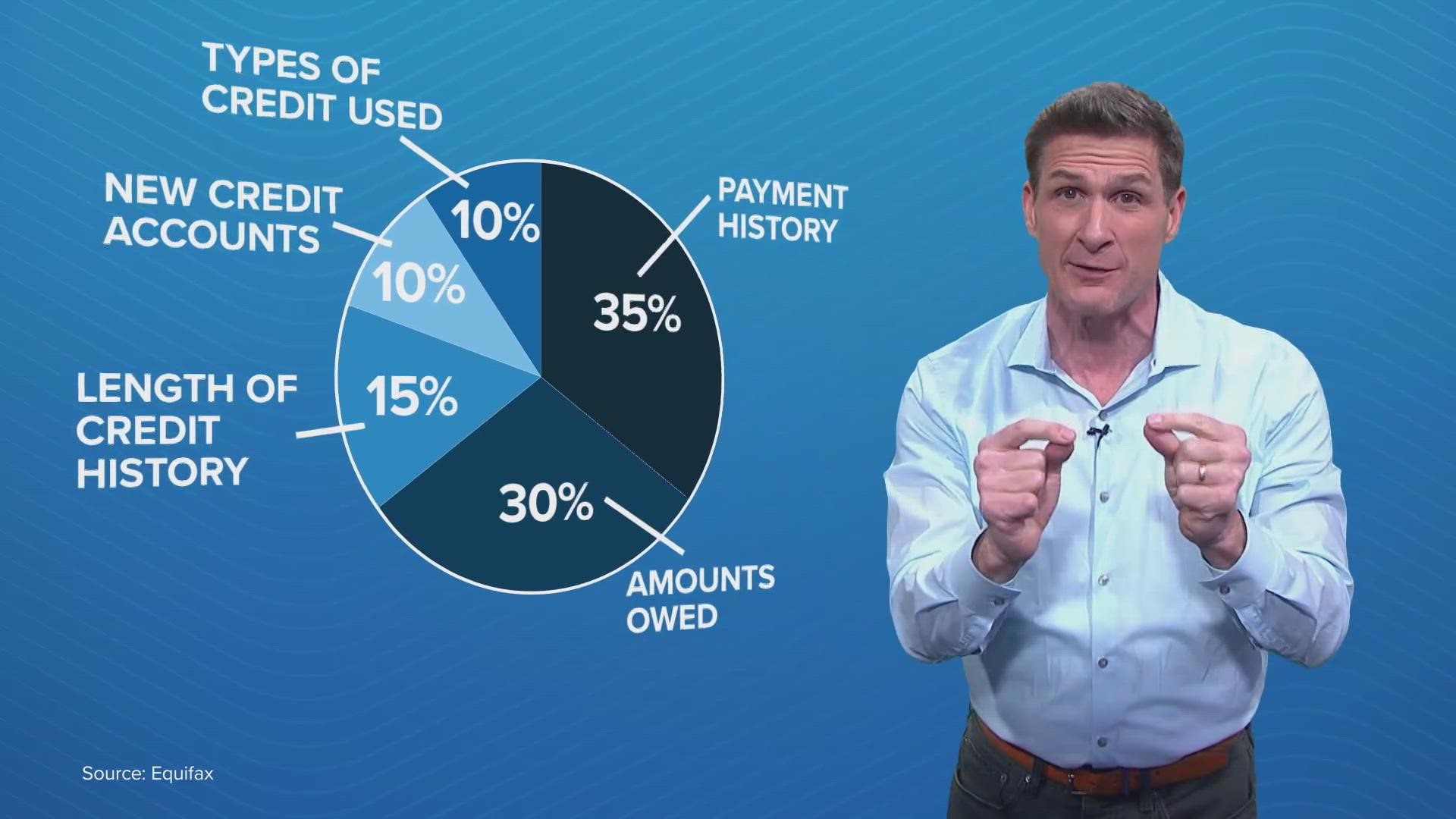

The average card balance per borrower is $5,474. Getting debt under control can be an unpleasant process. So, let’s have some pie. Sorry—make that just a pie chart, because it is important when you are struggling to control your credit card debt to be mindful of your credit score, which is weighted on these considerations.

The biggest factor is payment history. Late or missed payments hurt. And even if you close a card where you have had bad history, that bumpy past can stick to your credit report for years. Really try to avoid that.

Some good news: The percentage of seriously delinquent credit card accounts has recently been coming down from pandemic highs (See the third chart here).

Let’s get another piece of pie. The amount you owe is also a huge portion of the pie chart that makes up your overall credit score. Within this is what is called your credit utilization ratio. That is how much of your potential credit you’re actually using. A lower number is better.

Let’s consider a credit utilization ratio just with credit cards. Say you have three cards with a combined limit of $9,000 and you have $4,500 in total debt on them (for this experiment, let’s assume you have $2,000 dollars in debt on one card, $2000 on another, and $500 on the third card). Your total debt of $4,500 is a 50% utilization ratio because it represents half of your combined credit limit of $9,000.

So, you decide to just pay off the $500 balance on your third card and close that one. The problem is now you’re left with two cards that have a total credit limit of $6,000. And the $4,000 you owe on them now gives you a 67% utilization ratio. You're going in the wrong direction.

So let’s look at the credit report pie again. The length of credit history is important to your credit score. Here, a higher number is better. If the card you get rid of happens to be the one you have had the longest, now the average age of your credit card payment data is going down. That’s not good.

Instead of getting rid of the card, you might resolve to just stop using it. Beware there, too. After a certain amount of inactivity, a bank can close your card. Again, in some circumstances, that could make the age of your credit data go down and the utilization rate of your credit cards go up.

If the card isn’t costing you anything, there is some advice that you might want to keep it open and just periodically make a small purchase…and then pay it off when the credit card bill arrives.