AUSTIN, Texas — In this legislative session, Texas lawmakers entered the capitol with a record amount of capital: a $32.7 billion budget surplus.

And leaders were determined to use a big chunk of that to bring down property taxes in Texas, which are now reliably among the highest in the country.

This is top of mind for many Texans who just received appraisal notices with big jumps in value. That sets up the potential for yet another year of big increases in property tax bills once tax rates are set by different taxing authorities in the months ahead.

So, how is that state property tax relief coming along?

Well, it’s complicated.

The Senate plan versus the House plan

Republicans have controlled both houses of the Texas legislature for decades. But there are intra-party power struggles and differences of opinion on how to tackle big issues sometimes, and this is one of those occasions.

This session, there has been a tug-of-war going on between Republican leaders in the Texas House and the Texas Senate over how to lower property taxes.

Both chambers would send billions of dollars more to school districts around the state. Those districts would then be able to lower their tax rates because if they are receiving the extra funding directly from the state, they would no longer need to raise as much money from property taxes.

Additionally, the House has been focused on capping the amount that a homeowner’s appraised value can go up. Currently, a homesteaded residence can’t go up in appraised value by more than 10% each year. The House plan would cap that maximum annual appraisal increase at 5% and would extend that same limitation to business properties.

That has gotten no reception in the Senate, which is also dedicating additional money to bring down property taxes levied by school districts. The Senate has also been pushing a plan to increase how much of a homeowner’s property can be exempt from property taxes, by increasing the homestead exemption from $40,000 to $70,000.

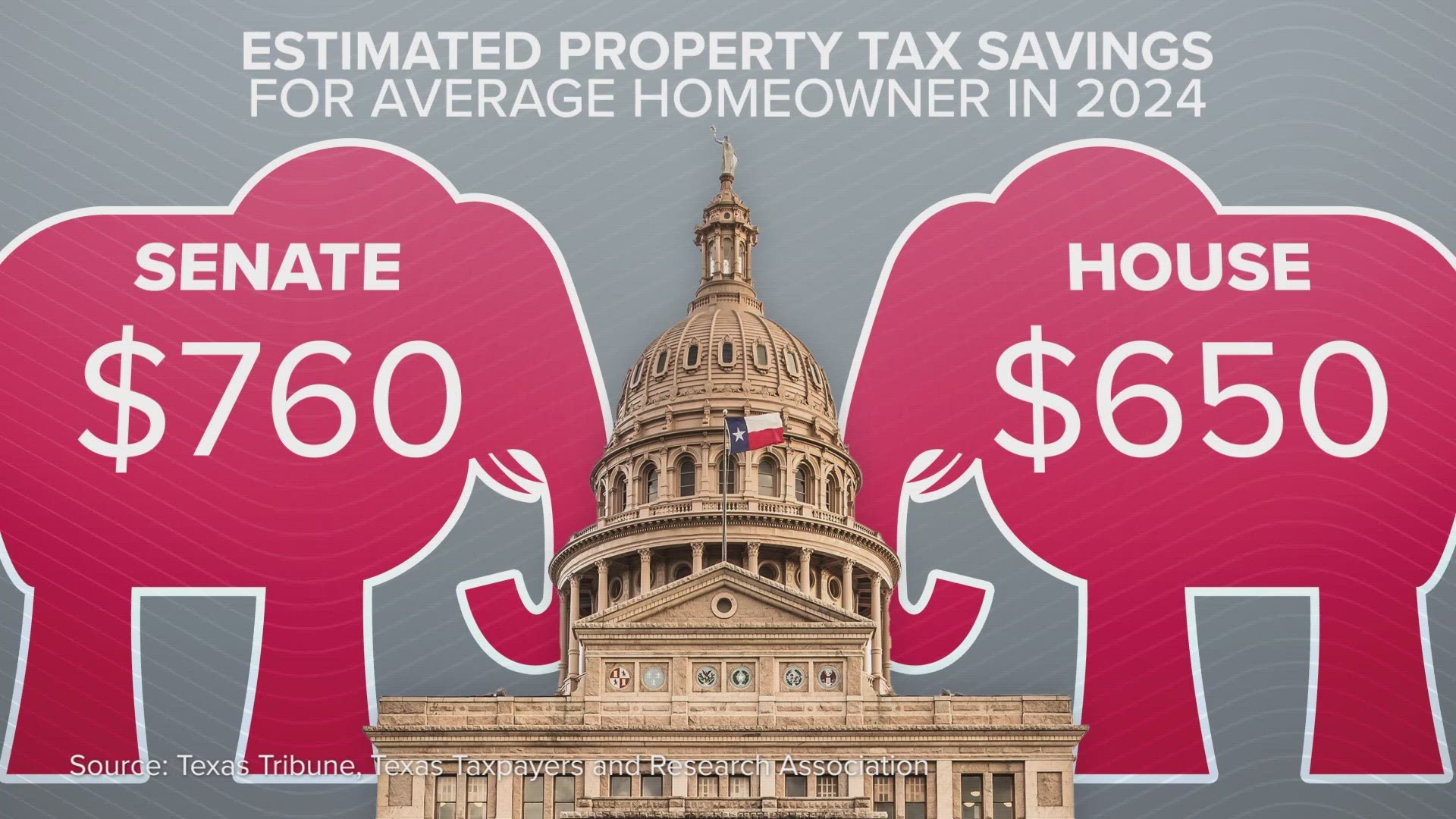

Estimates have varied on how much each proposal might save the average homeowner starting in 2024.

As the Texas Tribune recently reported, "An analysis of each chamber’s proposal by the Texas Taxpayers and Research Association… estimated that, combined with tax cuts already built into the state’s proposed budget for the next two years, the average owner of a $300,000 home would save about $650 on their 2024 tax bill under the House proposal and about $760 under the Senate plan."

And the estimates change for years after 2024. Additionally, others have reported numbers that differ from the figures above. That may leave some property owners unsure of who to root for in this battle at the capitol.

Or some may be rooting for both chambers, hoping for a combination of the relief plans.

That’s basically what the House did late last week, still insisting on that appraisal cap reduction that the Senate has been cool to, but also adopting, and even increasing, the Senate’s proposed $70,000 homestead exemption to $100,000.

The issue has to be taken up again by the Senate now. But time is running out on the legislative session, which has just one week left.

If the latest House version isn’t agreed to in the chamber across the capitol, a deal will be hard to come by before the clock runs out.

The big relief that has long been pushed by Texas politicians may have to be decided in a special session.