TEXAS, USA — Recently, an incredulous renter reached out regarding a lease renewal offer they had received for their suburban DFW studio apartment that measures just over 600 square-feet and has a view of nothing, really.

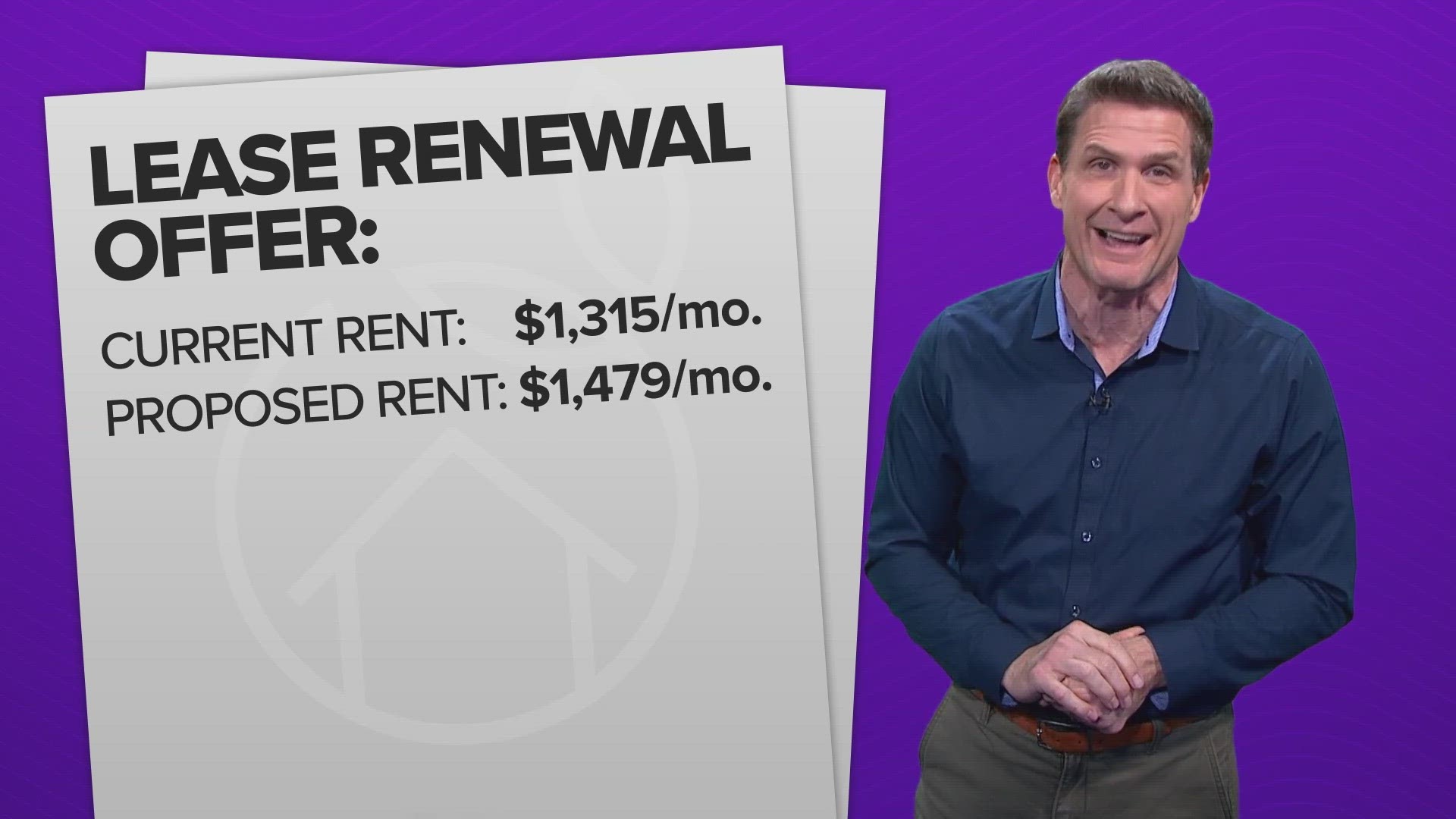

The offer would raise the rent from $1,315 a month to $1,479, about a 12.5% increase. That is on top of the hefty increase of about 10.6% they agreed to when they signed for another 12-month term last year. The numbers are counter to published data that shows a leveling off or a drop-off in rental rates in the primary rental markets and their submarkets in major Texas cities like Dallas, Houston, Austin and San Antonio.

Was the rent set by a human?

The renter took that information to the leasing agent at their complex, who was also surprised by the size of the increase. The renter says the agent chalked it up to the automated program that helps determine rent offers.

Translation: The algorithm did it.

That’s not unusual.

Some U.S. senators have asked the U.S. Department of Justice to investigate computerized rent recommenders, alleging that they “fix rents” and that they have “created a cartel of landlords”, something denied by some of the companies that offer the programs. Firms behind the software products claim there is nothing illegal about them, but the algorithms are the subject of multiple class action antitrust lawsuits from tenants.

Those will take a while to sort out. In the meantime, the renter who reached out needs to figure out what to do now. It was productive for them to talk to an actual person (the leasing agent) because that person began looking at how they could make the renewal offer more palatable. Equally important: When you have that conversation, try to stay calm and be nice. That goes a long way.

Negotiating rent increases

This tenant also wisely passed along that they had talked to others in their building whose rents recently went up much less that what was being proposed in this renewal offer. The renter also revealed that when they searched for available units at their same property, they found an identical unit just down the hallway from them listed for just $5 more than their current rent.

All those data points helped them convince the leasing agent to raise their rent a little more than 2% instead of the original 12.5% that had been proposed. If you have to go through this process, it might also be helpful to know that estimates show that for each tenant turnover, a property loses between $1,000 and $5,000 on average.

It benefits them to keep you. It also benefits you to know how to negotiate. Some important tips on how to do it and when is the best time to do it can be found here, here, and here.

The cost of buying a home might be making your rent rise

This might be emboldening some landlords who are looking to sharply increase rents: According to a principal at John Burns Research and Consulting, some big investors in apartment complexes have data that shows the number of renters moving out of apartments so they can purchase a home are down 30-50% in some cases.

The Federal Reserve has been aggressively raising interest rates, and mortgage rates have followed that trend this year, going from around 6% to near 8%. That monthly interest payment on a mortgage has become significant enough to dissuade some renters from daring to purchase a home.

Even when rates were back at 6.25%, the National Association of Home Builders estimated 96.5 million households were unable to afford the median-priced new home.

At recent mortgage rates, Zillow estimates that if you had a 20% down payment, you needed to earn $80,000 a year in Houston and $82,000 in San Antonio just to afford the typical middle tier home. They figured you needed to pull down $102,000 in Dallas and $129,000 in Austin to afford the middle tier home.

But, according to sales data from the Texas A&M Real Estate Research Center, in the past several months, home prices in major Texas cities have stopped rising, or have even started going down. Zillow notes that more sellers are slashing their prices and they expect that trend could continue in the months ahead.