DALLAS — There are some new dispatches coming from the "forced financing" frontier. Many Texans who secured pre-approval for auto financing from their lender in recent months complain they have been running into a serious dilemma at various dealerships across Texas when they try to buy a vehicle.

More complaints from consumers

Here are snippets of some of the complaints about dealerships that consumers have been sending to the Office of Consumer Credit Commissioner (OCCC), which is the regulatory authority over auto dealerships in the state:

“…would not accept my pre-approved financing…”

“…would not allow me to use my credit union check. Wanted me to use in-house finance…”

“We were forced to use their financing at 7% interest…”.

Months ago, the OCCC said, “we are concerned,” when WFAA's Jason Wheeler first alerted them to the practice of dealerships refusing outside financing and insisting that you use the lenders with whom they work.

It’s no secret that when a dealer works out a loan with its preferred lenders, the dealer can add on to the financing rate and pocket some extra profit.

It's not illegal in Texas

To be clear: Many consumers find the practice distasteful, but it is not illegal. The OCCC confirms there is no state law against it.

Still, the OCCC has not only expressed concern, the office has asked consumers who experience this phenomenon to report it to the agency so an investigation can be conducted.

And dealers must respond to OCCC investigations.

In the latest batch of consumer complaints and dealer responses, there was a clear trend in many dealer replies.

Here are a few snippets of what investigators say they were told by dealers:

“They take…outside financing”

“…cash, bank, and credit union”

“…they don’t require to use their financing”.

Again and again, different dealers essentially said they didn’t do what the consumers said that they were doing.

And over and over, the investigation ends there if the complaining consumer doesn’t have documentation; it was simply a consumer’s complaint versus a business’s denial.

If you can, get it in writing

Some advice: Get their words in writing. Wheeler personally went through this a couple of times last summer.

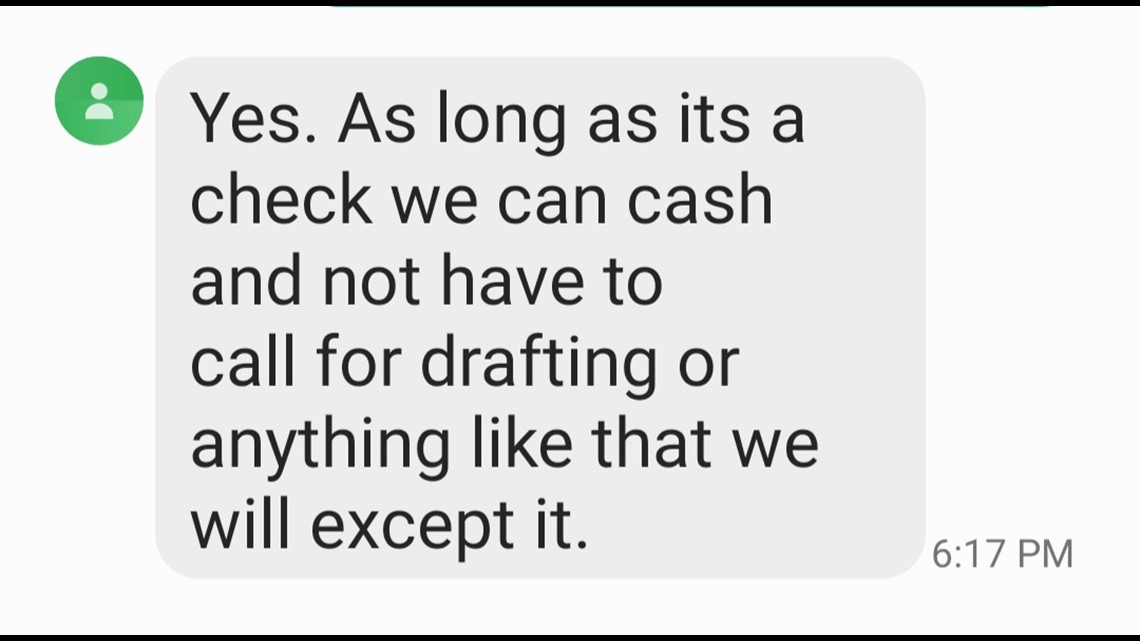

In one instance, the dealership said via text they would not accept outside financing unless Wheeler's lender could give him a cashable check to give to them.

Wheeler texted back to confirm that he was going to get a cashable check to hand to them and they responded they would accept that and made it clear exactly what they needed from him.

Wheeler's lender was already aware of the phenomenon of "forced financing" at the dealership and was happy to meet the demands being made by the dealership.

It may be a good idea to start shopping for a vehicle online. If you find one, email or text back and forth with a representative from the dealership. Tell them in writing if you have outside financing. Ask if that’s accepted. If they say no, you have it in writing for a potential future complaint to the OCCC.

If the representative from the dealer says they will accept outside financing, and you go to the dealership, and they tell you after you arrive in person that outside financing is not accepted there, follow up with them later by email or text to ask why they didn’t accept your outside financing.

Some are giving in to the dealer and then refinancing with their pre-financing

Some consumers say they have been getting around this conundrum by accepting the dealer loan, and then immediately refinancing with their pre-approving lender, which was offering them better terms.

If you suspect you might try to do that, talk about it first with your pre-approving lender to make sure that their refinancing rate would be the same as the purchasing rate they offered you.

Also, if you employ this method of accepting the dealer-sourced loan knowing that you are going to immediately refinance with your lender, make sure to read all the fine print of the loan at the dealership to make sure there are no penalties for paying off that loan early when you refinance.

Look here for more info on what you should be looking out for specifically.

How to complain about 'forced financing' at the dealership

To file a complaint about "forced financing" at the dealership, you can report your experience and send any relevant documentation to the Office of Consumer Credit Commissioner.

You can contact the OCCC's Consumer Assistance staff by calling them at 800-538-1579, by sending an email to consumer.complaints@occc.texas.gov, or you can file a complaint through their website.

More updates to come.