DALLAS — Would-be buyers waiting for home prices in Dallas-Fort Worth to drop or at least stop rising so darn fast are going to have to wait a while longer.

The median price of single-family homes in DFW reached $425,000 in the second quarter, and house prices are climbing faster in North Texas than they are in any other Texas metro area, according to a new report from Texas Realtors.

The median DFW home sale price in the second quarter increased 21.4% from a year ago, compared to a 19.1% increase statewide. The statewide median price is now $357,388.

San Antonio had the second-highest price appreciation rate among the state's major metros, with second-quarter sale prices up 20.2% year over year to $334,646.

In Austin, single-family home prices in the second quarter rose 17.4% year over year to $546,000.

In Houston, home sale prices climbed 16.6% to $349,999.

The soaring prices in DFW came as Q2 sales volume decreased 6.6% year over year to 28,354 single-family home sales.

Statewide, home sales decreased 5.6% compared to the same quarter last year to 108,390.

Not only are prices continuing to climb in DFW, but many sellers continue to receive multiple offers, with some of those at above-asking price, said Rick Haase, president of Dallas-based United Real Estate.

The DFW market remains hot despite much higher mortgage rates than a year ago, and homes priced at less than $1 million are in especially high demand, Haase said in an interview Wednesday with the Dallas Business Journal.

“The entry-level to median price point homes are still getting multiple offers and selling very quickly,” Haase said. “From median up to the mid-range and into the higher-end markets, the market is seeing fewer multiple offers. When a property is priced right in that entry to median price point it's extremely sought after and multiple offers are still happening.”

The good news for buyers is that housing inventory levels are finally climbing in most markets nationwide, including DFW and Texas as a whole, Haase said.

There were 16,455 active listings in Dallas-Fort Worth, up 48.7% from a year ago, according to the Texas Realtors report. That’s a 1.8-month supply. A six-month supply is considered ideal.

Housing supply across Texas increased 0.8 months in the second quarter of 2022 to 2.1 months of inventory. This is the first time the supply has grown year over year since the third quarter of 2019 and the first time it has been above two months of inventory since the third quarter of 2020.

Homes statewide spent an average of 27 days on the market before going under contract, five days less than the second quarter of 2021.

“Housing inventory levels are finally on the rise in many areas of the state — something we haven’t seen for several years — but home prices continue to rise,” said Russell Berry, chairman of Texas Realtors.

The data signifies a transition in the Texas housing market, said Jim Gaines, an economist with the Texas Real Estate Research Center at Texas A&M University.

If inventory continues to steadily climb and home sales price appreciation begins to cool, the market could be moving toward “a pre-pandemic environment,” he said in the Texas Realtors report.

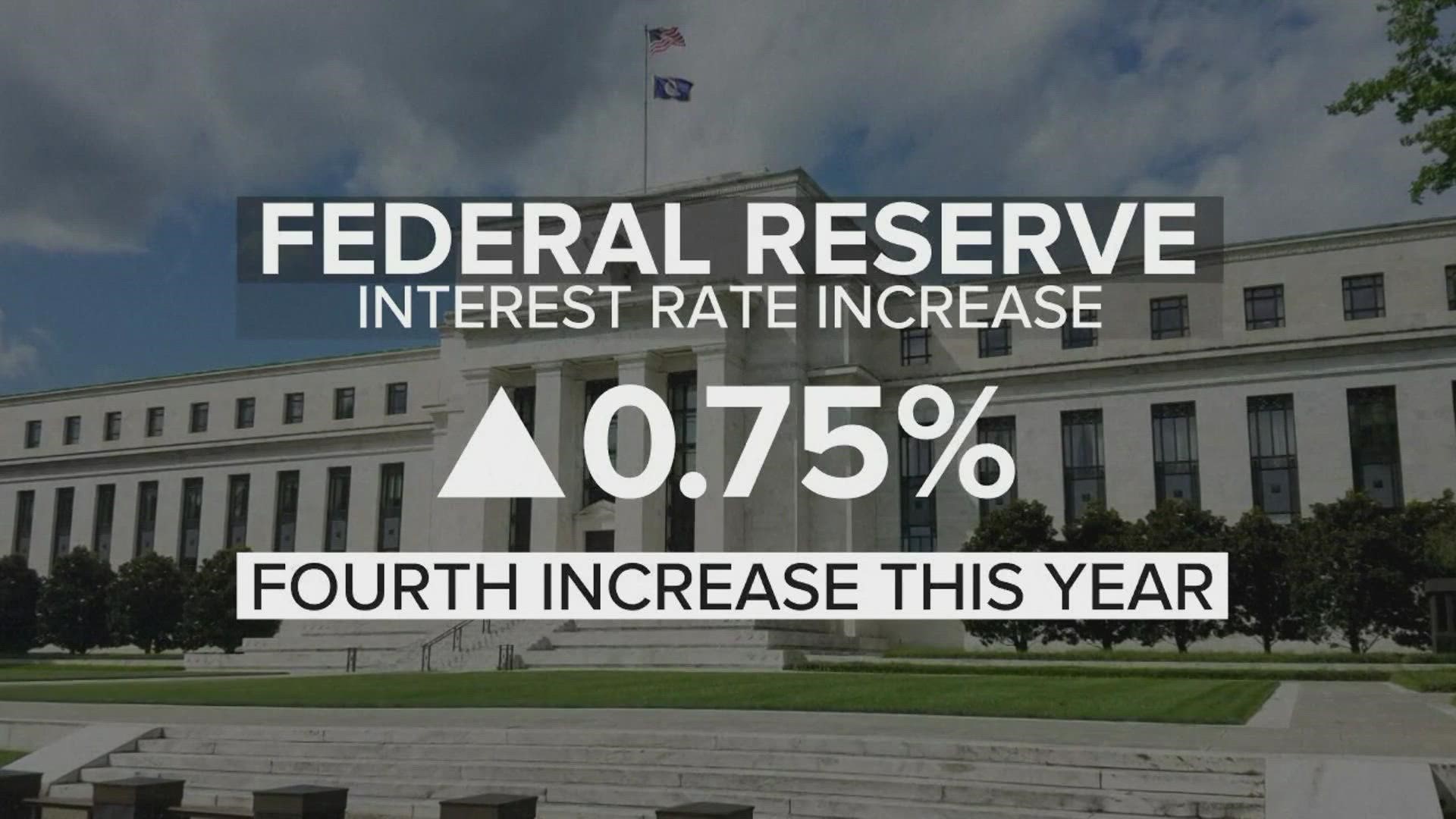

“The rapidly rising interest rates, increases in home price, and tight housing inventory had a slowing effect on home sales in the second quarter of the year,” Gaines said. “But the Texas housing market is still strong.”

The results of the Texas Realtors study closely resemble another recent study that found Dallas-Fort Worth leads the U.S. for the largest percentage increase in the median home sale price, soaring almost 30% over last year.

The median DFW home sales price rose to $426,000 in June from $329,500 in June 2021 — a jump of 29.3%. The next highest increase nationwide was in Tampa, Fla., up 27.9% to a median sales price of $385,000, according to the latest Re/Max National Housing Report.