DALLAS — When Missy and David Williams went to South Sudan on a church mission trip in 2007, they had no idea where it would lead them.

“We didn’t even know where South Sudan was,” said David Williams who was 32 at the time. “I thought honestly it was in the Middle East.”

But, a passion for helping people led the couple on a 15-year quest to guide refugees in creating a way to change the trajectory of their lives.

South Sudan, they would learn, had been racked by civil war. Millions of people were fleeing south to Uganda to escape the violence. Although religious missions, like the one they were on, would provide spiritual solace in refugee camps, the fundamental problems of day-to-day life weren’t being solved, they said.

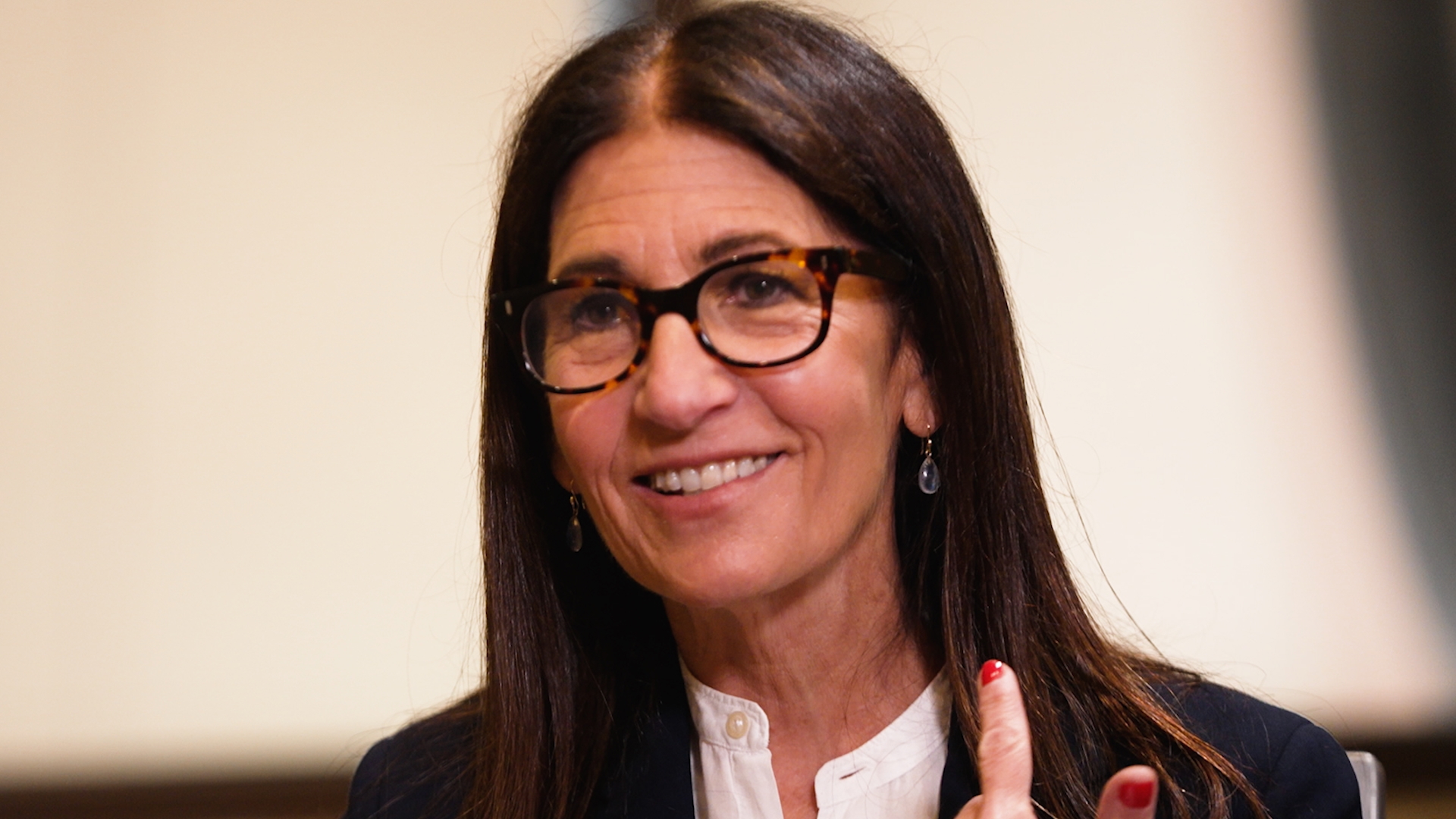

“People told us ‘My child has malaria and I can’t afford the medicine,’’ Missy, then 27, recalled.

“I don’t know how I’m going to take care of my family,” was a common refrain, she said. “It was overwhelming.”

On their last night in the country, a meeting with a group of women yielded an epiphany.

“We were standing in a circle in a mud hut, and with the help of a translator, they asked for a sewing machine,” Missy recalled. “'If we can have a sewing machine, we can help start a business to provide for families to put one of the kids in school.’”

So began a tedious trek to forge a charity Missy and David named Seed Effect, beginning first in South Sudan and ending up in northern Uganda, directly south of South Sudan, where refugees were coming from.

The concept behind Seed Effect is microfinance. Fifteen to 25 people in a village will come together. Each will chip in a small amount of money to establish a lending pool and an "insurance fund." Following rules set by Seed Effect, with oversight by a trainer, they will be able wait in line to borrow small amounts of money from the pool, paying interest - usually about 10% - while repaying the loan. The money in the pool grows from the interest.

Group members use the loans to start businesses, buy livestock or enroll their children in school. The insurance fund is for members of the group with financial emergencies, such as a health crisis. So far, Seed Effect members have collectively saved more than $4.8 million.

Parallel to the loan program, members are enrolled in a bible study group, which Missy said many find is just as valuable as microfinance.

“It gives them a chance to share their traumatic experiences as refugees,” she explained. “They can find common ground in what they’ve been through.”

According to the World Bank, 1.7 billion people in the world have no affiliation with a financial institution. That’s more than the population of China. In World Bank speak, this is called the “financial exclusion gap.” Uganda, also according to the World Bank, has thousands of village savings and loans similar to Seed Effect that bridge that gap. The advantage to banks? The method doesn’t require collateral to borrow money and it charges about a third as much interest.

From beginning to end, each savings group at Seed Effect lasts from nine months to a year. Members report that their nutrition improves, their livestock ownership increases, and many acquire electricity in their residences. Nearly all re-enroll for another cycle after their first is finished.

“It’s very, very good because they keep accountability with one another,” pastor Moses Akitwine explained. "They support one another, and then they return that money. So, you don’t need any collateral to put there.”

Akitwine’s church, Heavenly Bridge ministries, has feet in both north Texas and southwestern Uganda. His father started a church in Uganda 60 years ago. Now, his reach includes a seminary, orphan care, a trade school, water well drilling and, of course, microloans. Akitwine goes from Hurst back to his home country four times a year to help manage the ministry.

One of his favorite stories involves a woman named Rachel and two pigs. She got a microloan for $200 hundred and bought two pigs two years ago.

“When I went back to Mbararra (southwestern Uganda) last time, she had forty pigs. Forty pigs!" Akitwine exclaimed. "I didn’t know that these pigs, they give (birth) two times a year. And they have six piglets.”

Now Rachel, a single mother, plans to use her pig money to open a convenience store, an emotional experience for her as well as the people who have seen it happen.

Within Seed Effect, which now employs 200 Ugandans in country, the reward has been as deep for Missy and David Williams as it has for the refugees.

“The number of times I’ve gotten to sit across from a refugee, and they share their story, which feels like stepping into a very holy space, honestly a very sacred space…..but to hear such brokenness and unfairness, just a matter of zip code, you know, you were born in this place and I was born in that place. That might be my story.”