Editor's note: On Saturday, April 4, Bank of America said it expanded access to the Paycheck Protection Loan Program to all of its small business clients. On Friday, the first day the federal stimulus was available, Bank of America said it received 106,000 applications from businesses seeking $26 billion.

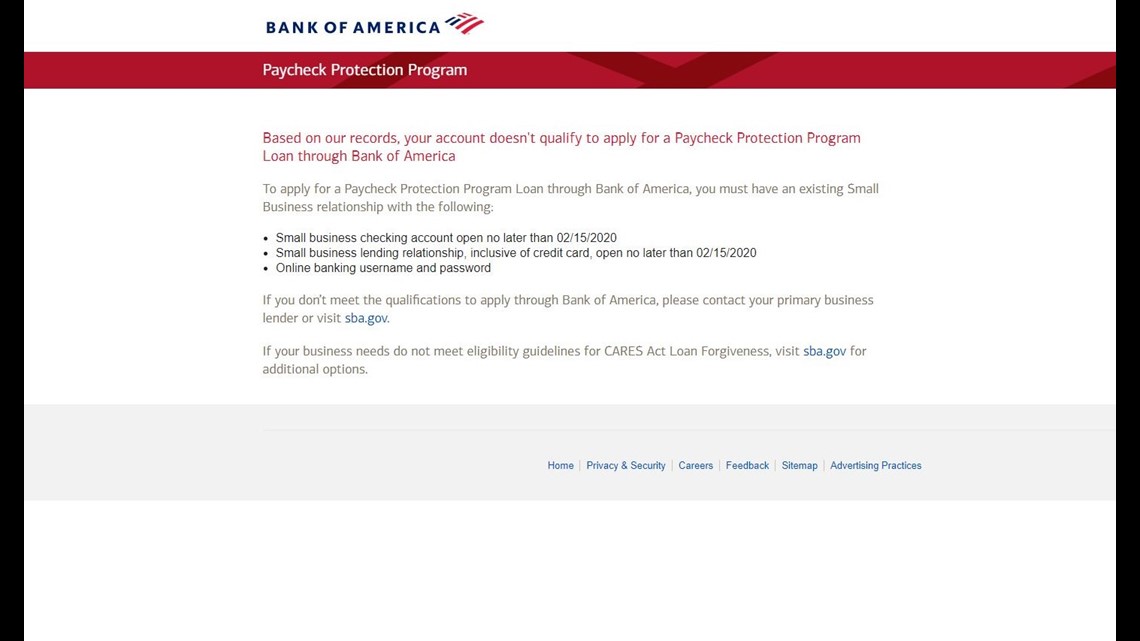

Bank of America has created its own guidelines and is deciding which small businesses can apply for the limited federal stimulus loans first.

The bank has received more than 58,000 applications for the Paycheck Protection Loan Program -- worth $6 billion, a spokesman told WFAA.

But the nation's second-largest bank is only accepting applications from small businesses that also have one of the bank's credit cards or those that have taken out a previous loan with Bank of America.

Simply having a small business account with the bank isn't enough for applicants.

“We know for these businesses speed is of the essence. We can move fastest with our nearly one million small business borrowing clients. That is our near-term priority. As the administration has made clear going to your current lending bank is the fastest route to completion,” said William Haldin, a Bank of America spokesman.

The problem is, Congress did not write such limitations into the law.

Federal lawmakers and President Donald Trump have widely publicized the Paycheck Protection Loan Program as being available to all small businesses.

The Paycheck Protection Loan Program is part of the CARES Act that Congress passed last week and that the president signed into law. It’s designed to let small businesses with 500 employees or fewer, apply for money to continue paying their staff for two and a half months.

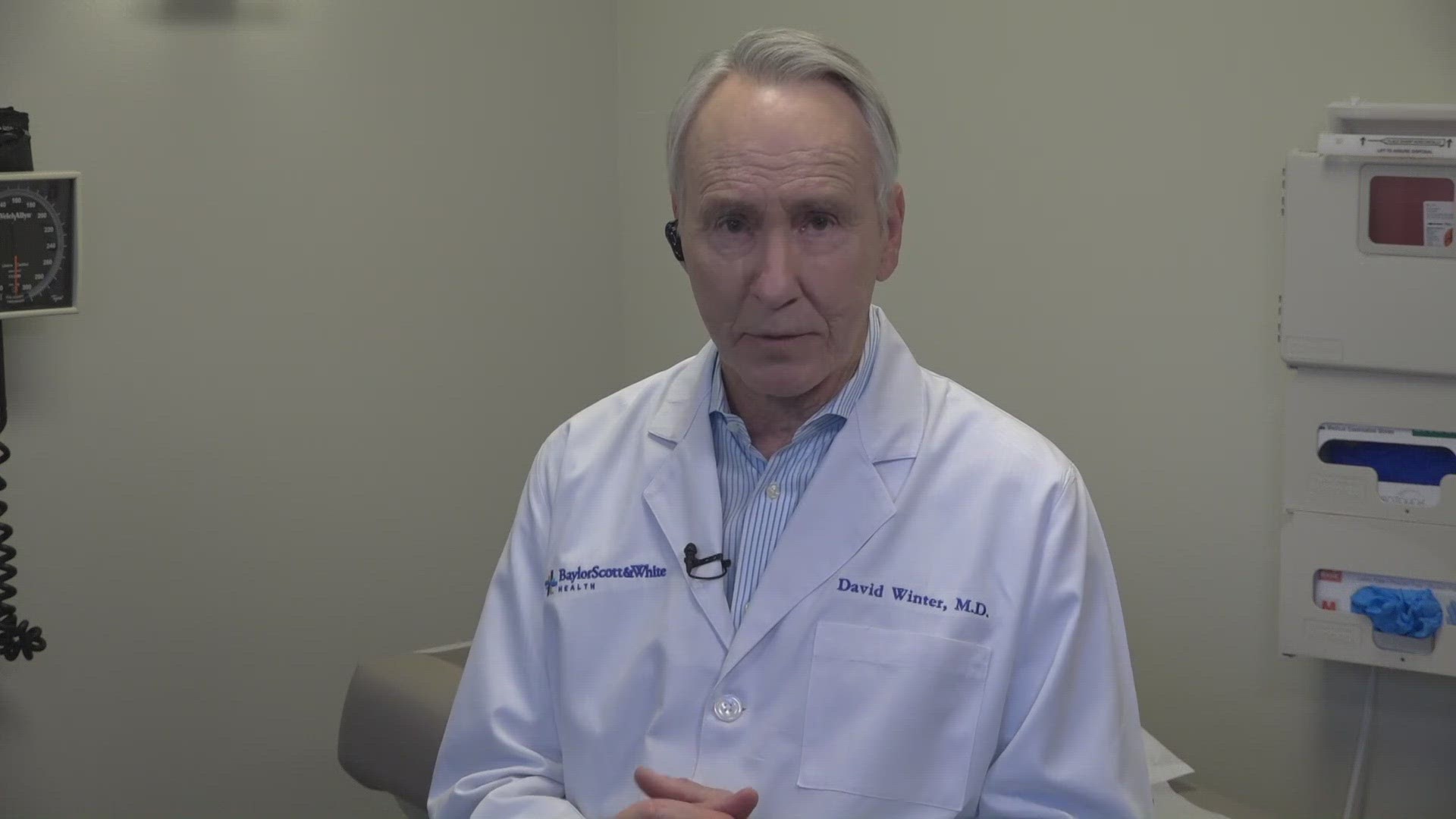

Private banks, such as Bank of America, write the loans to their small business customers and the Small Business Administration backs them.

Those loans are forgiven if small businesses can prove the money was spent on salaries, utilities or rent.

Congressman Colin Allred said the federal stimulus money is intended for everyone, not just businesses that already have loans with certain banks.

"There's enough money available," Allred said. "As long as they have the capacity to take loans and to take applications, they should be issuing those loans as quickly as possible."

Allred said some of the "mom-and-pops" and self-employed may not have accessed credit before. That shouldn't keep them from accessing this money, he said.

On Friday, as Bank of America moves a million of its customers to the front of the line for these forgivable loans, many of its other customers have taken to social media to complain.

“Paycheck protection program is great in theory but letting these big banks come up with their own guidelines is absurd,” wrote @Johndipace on Twitter.

“I’ve been in business for 18 years. I’ve never borrowed any money or had a business credit card. My bank will not allow me to apply for the Paycheck Protection Program to save my employees. Same with most banks. Who is this really helping,” asked Kulinda D. Rollins on Twitter, using the handle @biznesswoman.

“We have been Bank of America customers for 25+ years and they are excluding us from applying to the Paycheck Protection Act loans because we have not previously needed a business loan through them,” wrote a Twitter user named @jaimes1205.

“At Bank of America it’s not good enough to be a customer to have access to the Paycheck Protection Program, you must also be a borrower. I will be moving all my accounts,” wrote M. Shafiq Hamdam on Twitter.

In a message to bank employees, Dean Athanasia, the head of consumer business at Bank of America, said: "It is only Day 1 and I assure you that we will continue to enhance our Paycheck Protection Program to accommodate more and more of our small business clients."

Bank of America’s chief executive officer made no apologies for treating some customers differently.

“Right now, we're focused on our borrowing clients and we want, as the treasury secretary said, the industry said, we want everybody to go to their borrowing bank. It's easier to process faster," said Brian Moynihan, Bank of America’s CEO on CNBC’s Squawk Box Friday morning.

"We have to focus on the borrowing clients to make sure we can take care of them. That's a core relationship," Moynihan said.

The bank insists speed is the reason it’s prioritizing some customers over others.

“It’s all about what we can do the quickest,” Haldin said. “The people we can be fastest with are the ones we have existing lending relationships with.”

The bank spokesperson could not immediately say how many thousands of other small business customers are getting pushed aside for those with existing loans.

The bank also has not said either when or if it would open up federal stimulus applications to all of its customers.

“We want to help people who don’t have a lending relationship. We’ll get to them as quickly as possible,” Haldin added.

More on WFAA:

- Dallas business commissions mural to honor health care workers

- Updated: Even more of your Texas unemployment questions answered

- Q&A: How small businesses hit by coronavirus crisis can get aid starting Friday

- What resources are available to Texans who are suddenly out of work?

- Before COVID-19, the Texas agency in charge of unemployment took 13,000 calls a day. They're now averaging around 1.5 million