ARLINGTON, Texas — The IRS Get My Payment tracker was set up to provide answers about the coronavirus relief payments, but for some taxpayers it only added to their coronavirus frustrations, as they ran into problems using the system.

Here are the top three most common questions about the tracker and some useful answers to each.

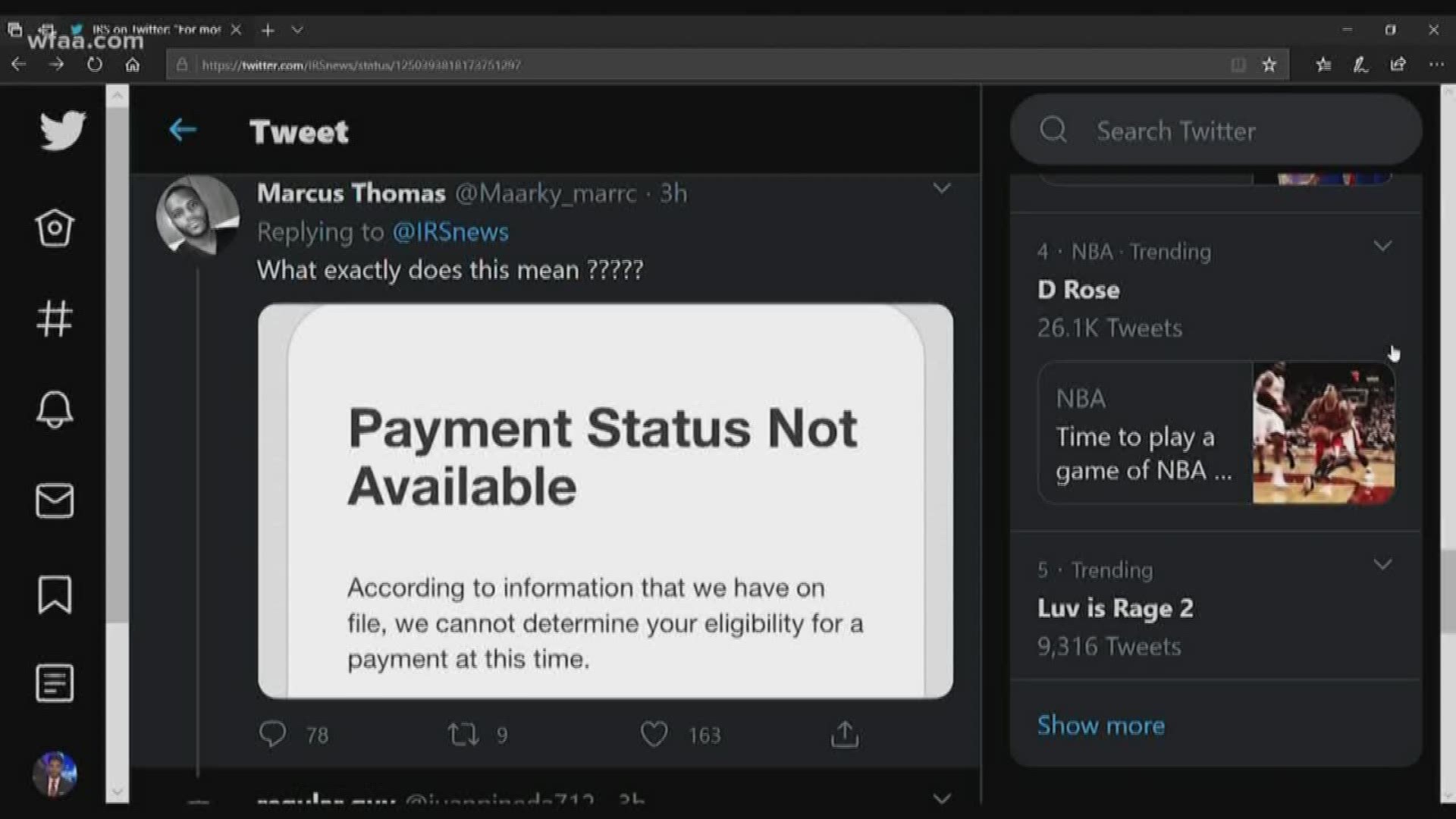

Payment Status Not Available

Since the payment system launched Wednesday, people took to social media posting screenshots of a message telling them the payment status is not available, after they'd submitted all their information.

If the IRS cannot determine your eligibility, it’s more than likely because you didn’t file a 2018 or 2019 tax return, or you recently filed and the return has not yet been processed. The status may change once the process is complete, according to the IRS website.

If you receive benefits from the Social Security Administration, Railroad Retirement Board, Supplemental Security Income or from the Department of Veterans Affairs, your information might not be available through the Get My Payment tracker.

Payments to inactive bank accounts

It’s unclear why, but the IRS says it cannot send a direct deposit to an account from which a taxpayer made a payment, if the account is different from one previously used to receive a refund.

Instead, the payment will be deposited into the last known bank account to which the IRS made a deposit.

If the account is closed, the bank will reject the payment and the IRS will send a check in the mail, according to the IRS website.

If the account is still open and the payment has processed, it cannot be changed, and it appears it'll be up to the recipient to figure out how to transfer the funds.

Getting locked out

Taxpayers also took to social media upset they’d been locked out of the system.

To use Get My Payment, taxpayers have to answer a series of security questions. If the answers don’t match IRS records multiple times you’ll be locked out of the system for 24 hours.

If you cannot verify your identity with the IRS you will be unable to use the Get My Payment system, but you may still receive the payment if you qualify.

Click here to see more common questions and answers on the IRS website.