Dallas-based Comerica Bank has bolstered its efforts to serve more local people and businesses due to the nature of the COVID-19 pandemic, Irvin Ashford Jr., the bank’s chief community officer, said in an interview.

Ashford said there are not only medical health-related risks with the coronavirus outbreak, but also business health-related risks. Businesses and people that were in need before the pandemic are certainly even more in need now, he said.

“Not only the external affairs group, but also the committed Comerica bankers have doubled down on assisting and serving (community) needs and those needs are various with regards to banking and financial services.”

Comerica has committed more than $8 million to address small business needs, Ashford said. This will be invested primarily in community development financial institutions, technical assistance programs and community programs, especially for low- to moderate-income communities.

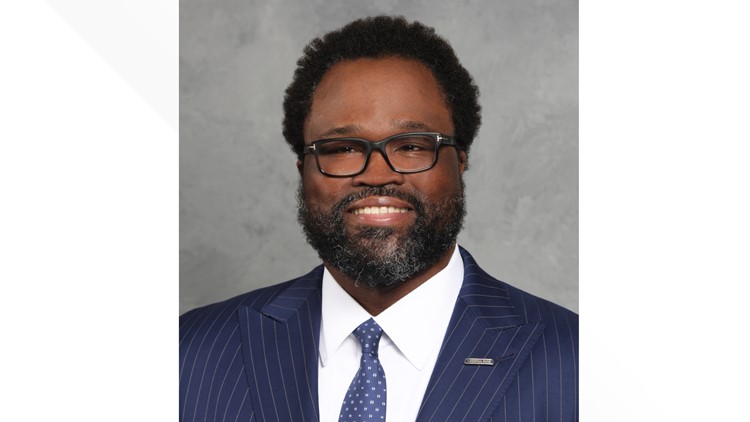

Ashford has been with Comerica (NYSE: CMA) for 20 years and oversees community reinvestment nationally, including development, lending, community investments, volunteerism and data analysis. Ashford also leads the bank’s diversity business resource groups.

Ashford spoke with the Dallas Business Journal about the initiatives Comerica is working on and the challenges that come along with it.

What are the initiatives your division is currently working on?

One of the programs, in general, that we're working on is how do we serve the needs of small business communities, particularly those in low-to-moderate income areas. How do we meet the needs of family members and individuals in those communities? We do this by addressing what I like to call Maslow's scale of needs: food, shelter, safety – the most critical needs that would occur after someone's business closed down or after they lost their job.

We're supporting food banks, supporting nonprofits that have community development services, supporting technical assistance providers to not only help small businesses with the problems that they may have had before the pandemic, but certainly after the pandemic if those problems are exacerbated.

Another program we're launching is [Comerica Bank Business $ense]. The program is our technical assistance, financial education program for small businesses, particularly here in Dallas. We're going to be partnering with a nonprofit or a few nonprofits to launch our boot camp programs where we're teaching technical assistance, allowing small businesses to have access to our bankers for expert opinions and access.

What are the challenges that you're seeing so far as it relates to the pandemic?

Some folks in low- to moderate-income areas are going to face some additional challenges with [the coronavirus pandemic] because they may not have access to the same technology that will allow them to hold virtual sessions, virtual training or sell their goods virtually. I think that's one of the major challenges particularly for low- to moderate-income communities, people and businesses that provide services in those communities or are set up in those communities. Access to technology, access to broadband WiFi is the major challenge for them.

[There are also the] same challenges before the pandemic. Small businesses have a high failure rate because doing business is hard. What we try to do is provide small businesses with trusted advisors and people that can help them with their educational gaps. Small businesses face a lot of challenges. Sometimes it's [due to] lack of resources, lack of funding and sometimes it's lack of information.

For a longer version of this story, click here.