Tired of paying ridiculously high property taxes in Texas?

One North Texas leader said he has a plan to cut them in half.

“Property taxes have gotten way out of control,” Tarrant County Judge Glen Whitley said. “We’re the 13th highest right now in property taxes when you compare us to the other 50 states. And that’s just got to change. We’ve got to cut it. Not just reduce the growth, but we’ve got to find a way to cut it.”

And that ranking includes business property taxes.

If you only included homeowners, the Republican said we’d easily be in the top 10.

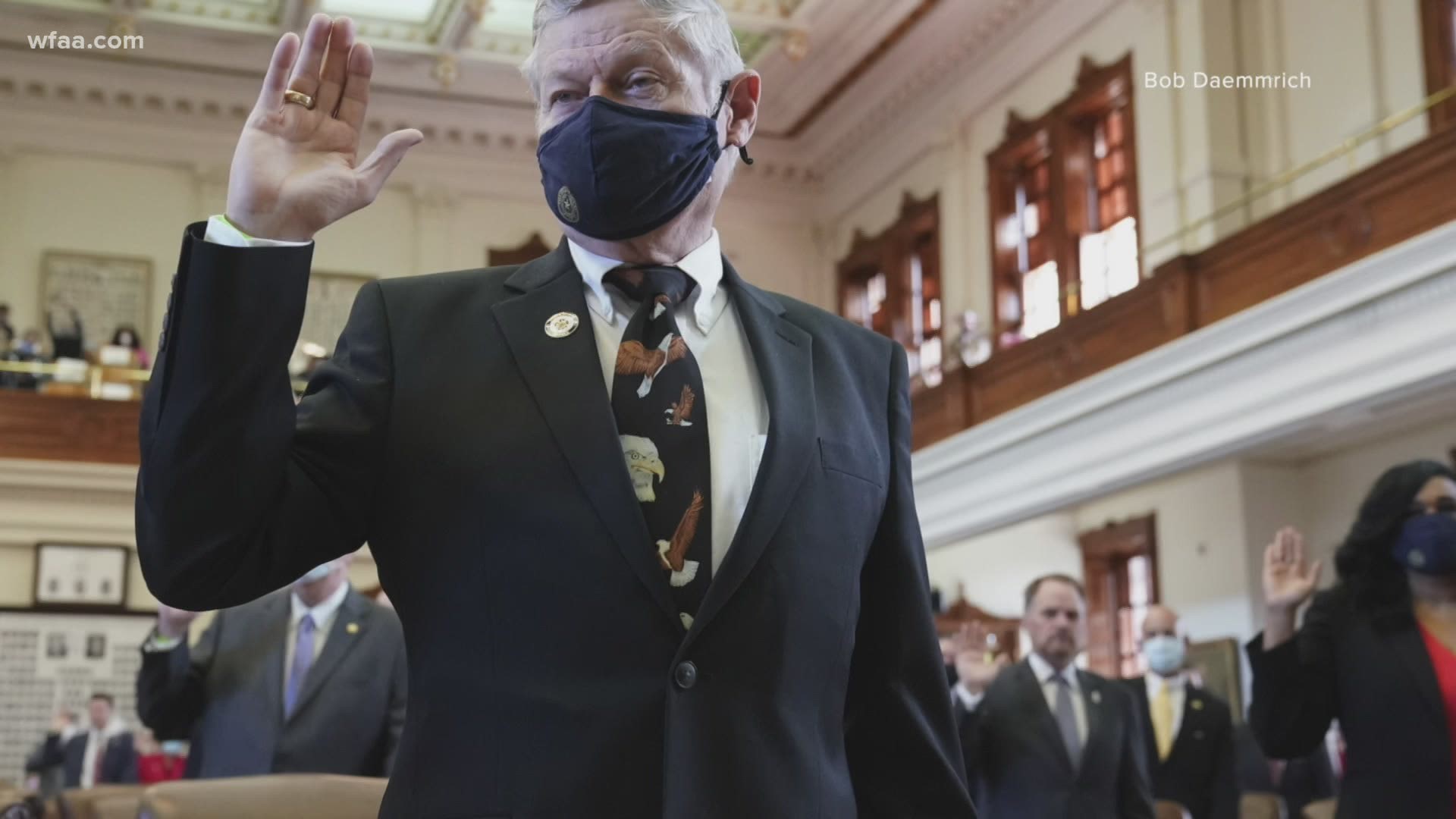

Judge Glen B. Whitely and Sen. Nathan Johnson joined Y'all-itics about some of the other legislative priorities for 2021.

To listen to this and future episodes of Y'all-itics, subscribe wherever you get your podcasts: Apple Podcasts | Google Play | Spotify | Stitcher

(Story continues below.)

Whitley said the state should start picking up the tab for the day-to-day operations of public schools.

“That’s the teachers. The bus drivers. The janitors. The administration. If they did that, the taxes, yours and my property taxes, would go down by over 50%.”

And the judge says even though it may seem like your local entities are the groups responsible for constantly raising property taxes, he says many times, the blame lies with the state.

He says lawmakers will often force local governments to provide a new service without providing the funding.

“We used to call it unfunded mandates. What I want to start calling it is a state mandated property tax increase,” he told the Jasons. “Because every time they pass something and then don’t send dollars with it, it causes us to have to increase the property taxes.”

But the state relies heavily on property taxes.

So where would we make up this lost revenue?

The judge said look no further than the other taxes we already have on the books.

“We collect almost 30 different taxes in the state of Texas. Two of those, property tax and general sales and use tax, account for over 81% of that tax burden. So, the first that they could do would be to look at the exemptions they currently have in place for all the different taxes that they collect,” he said. “They could also look at all those other taxes and see if they couldn’t take the savings from the property tax and spread that out among all those other taxes.”

While lawmakers are sure to talk about property taxes in some way, don’t hold your breathe waiting for them to implement Whitley’s plan during the session now underway.

“I don’t think anybody is likely to be able to lower your property taxes. But we can probably and have done something about them continuing to go up,” Sen. Nathan Johnson said on Y’all-itics.

Legislation passed during the last session capped the amount that cities, counties and other districts can raise through property taxes.

Johnson said he’ll hear from constituents about high taxes, but not as much as in previous years.

He said many times, homeowners simply call their central appraisal district.

The Democrat said part of the problem began decades ago.

“Since 1997, we had kind of a change in the tax code that we believe has been manipulated to shift the property tax burden from large commercial property owners to residential homeowners,” said the senator.

He said he wants to reverse that trend, but it’s a “very tough sale” because of lobbyists.

But Johnson said they’re getting closer.

And he thinks they can work out the framework for future changes during this legislative session, particularly as it relates to a “gross manipulation of values.”

“It’s not fair that an owner of a skyscraper is shifting their property taxes to local homeowners," he said.

Johnson said one issue that will receive a lot of attention from lawmakers can indirectly help to lower your property taxes and that’s Medicaid expansion.

“Another big component of your property taxes is your hospital district," he said. "And Medicaid expansion will take pressure off the continued cost of hospital district taxes.”

And both leaders said they want residents to remember something… albeit completely different points.

“What’s important is not the value of your property,” Johnson said. “It’s the tax rate that’s being applied.”

“The comptroller says we exempt almost as much as we collect in property and sales tax,” Whitley said. “So just think about that. We exempt almost as much as we’re collecting in those two taxes.”